Difference between ACH and Wire

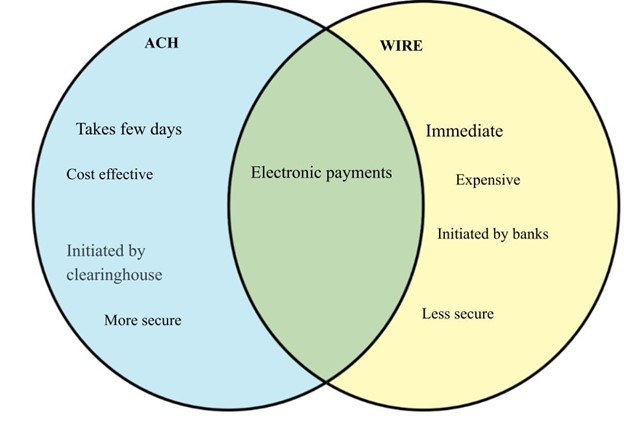

There are different types of electronic payments, from credit cards to PayPal to e-wallets. ACH and Wire transfer payments are two of these several electronic transfers that have existed for a while now. Funds move safely in these two modes of payment, and there's nothing to worry about. The bank keeps a record of the transaction, so you can easily track its progress. Let's take a look at each of these two forms of electronic payment methods and the difference between them.

What is ACH?

Automated Clearing House is long for ACH. This electronic inter-bank payment and financial transaction network in the United States process many credit and debit transactions in batches. ACH transfers include direct deposits, payroll, and payments to suppliers. This includes insurance premiums paid by consumers, home loans, and other types of accounts, and it is done through the ACH network, not through card networks such as Visa or MasterCard. ACH payment is also commonly referred to as ACH transfer or ACH transaction. You can make direct deposits and direct payments with ACH. Direct deposits include all types of payments, from commercial or government deposits to consumer interest payments. Direct payment involves the use of funds by individuals or organizations to make payments.

What is Wire?

Wire transfer is also an electronic payment method between two banks. Wire transfers are instant because they do not need to be processed through a clearinghouse. If the credit limit is large, the recipient can request a wire transfer. For example, the lender may ask someone to transfer money for the down payment for a house. Wire transfers provide same-day access to these funds, making it easier to buy a house, for example.

| Ach | Wire | |

|---|---|---|

| Speed | Can take up to a few days | Is usually immediate |

| Cost of transactions | Free or low cost per transaction | Cost money for both the sender and the receiver |

| Processors | Initiated by clearinghouse | Initiated by banks |

| Security | More secure than wire | Low security compared to ACH transfer |

| Transfer initiation | Businesses/individuals can send and receive funds | Only the sender can initiate the transfer. |