Differences between Gross and Net

Contents

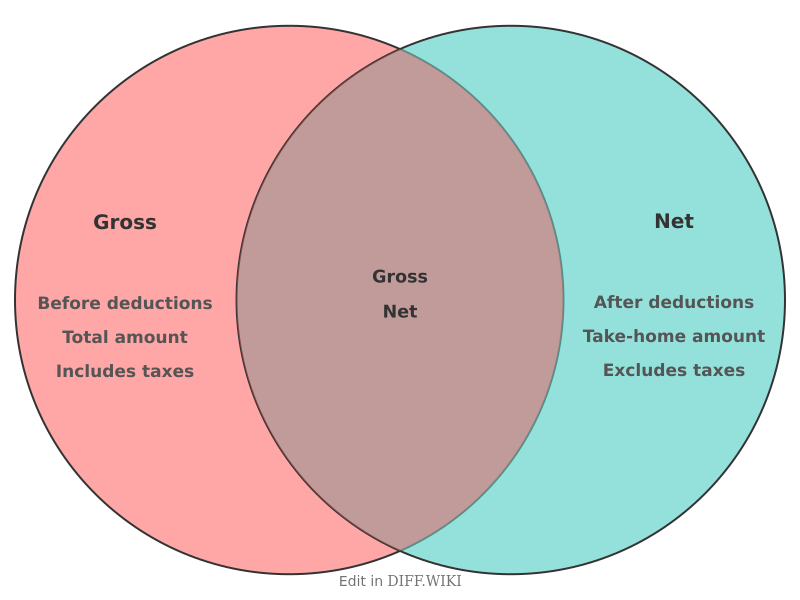

Gross vs. Net[edit]

Gross and net are terms used to distinguish between a total amount and an amount after deductions.[1] "Gross" refers to the whole or total amount of something, such as revenue or weight. "Net" refers to the amount that remains after certain deductions are made from the gross total.[1] Understanding the distinction between these two concepts is important in various fields, including personal finance, business accounting, and shipping logistics.

Comparison Table[edit]

| Category | Gross | Net |

|---|---|---|

| Definition | The total amount before any deductions.[1] | The amount remaining after all deductions are subtracted.[2] |

| Personal Income | Total earnings before taxes and other withholdings.[3] | "Take-home pay" after taxes, insurance, and retirement contributions are deducted.[4] |

| Business Revenue | Total sales revenue before deducting returns, allowances, or the cost of goods sold (COGS).[5] | Revenue remaining after subtracting returns, allowances, and discounts from gross revenue.[5] |

| Business Profit | Revenue minus the cost of goods sold (COGS). | Profit remaining after all business expenses, including taxes and interest, are deducted from revenue. |

| Product Weight | The total weight of a product, including its packaging and any shipping materials. | The weight of the product by itself, without any packaging. |

In Business and Finance[edit]

In a business context, gross figures provide a top-level view of financial performance, while net figures offer a more detailed picture of profitability.

Gross revenue represents the total income generated from sales before any adjustments like customer returns or discounts are made.[5] It is a direct measure of the sales volume a company can achieve. Net revenue is calculated by subtracting allowances and discounts from the gross revenue.

Gross profit is the profit a company makes after deducting the direct costs associated with making and selling its products, known as the cost of goods sold (COGS). This figure indicates how efficiently a company uses its labor and supplies in the production process. Net income, often called the "bottom line," is the profit that remains after all expenses, such as operating costs, interest, and taxes, have been paid.[4] It reflects the company's overall profitability.

In Personal Finance[edit]

For an individual, gross pay is the total amount of money earned before any deductions are taken out.[3] This is the salary figure often quoted in employment offers. Net pay, or take-home pay, is the actual amount of money an employee receives in their paycheck after all deductions have been made.[3] These deductions typically include federal and state income taxes, Social Security and Medicare contributions (FICA), health insurance premiums, and retirement plan contributions.[4] Because net pay reflects the actual cash available, it is the more useful figure for creating a personal budget.

In Commerce[edit]

The terms gross and net are also used to describe the weight of products, which is a critical factor in shipping and logistics.

Gross weight refers to the total weight of a shipment, which includes the product itself, its packaging, and any additional materials like pallets or containers used for transport. Shipping costs and safety limits for transport vehicles are often based on the gross weight.

Net weight, in contrast, is the weight of the product alone, without any packaging. This measurement is what a consumer is ultimately purchasing and is often listed on product labels, particularly in the food industry.

References[edit]

- ↑ 1.0 1.1 1.2 "corporatefinanceinstitute.com". Retrieved November 30, 2025.

- ↑ "finally.com". Retrieved November 30, 2025.

- ↑ 3.0 3.1 3.2 "adp.com". Retrieved November 30, 2025.

- ↑ 4.0 4.1 4.2 "paychex.com". Retrieved November 30, 2025.

- ↑ 5.0 5.1 5.2 "investopedia.com". Retrieved November 30, 2025.