Differences between NASDAQ and NYSE

Contents

NASDAQ vs. NYSE[edit]

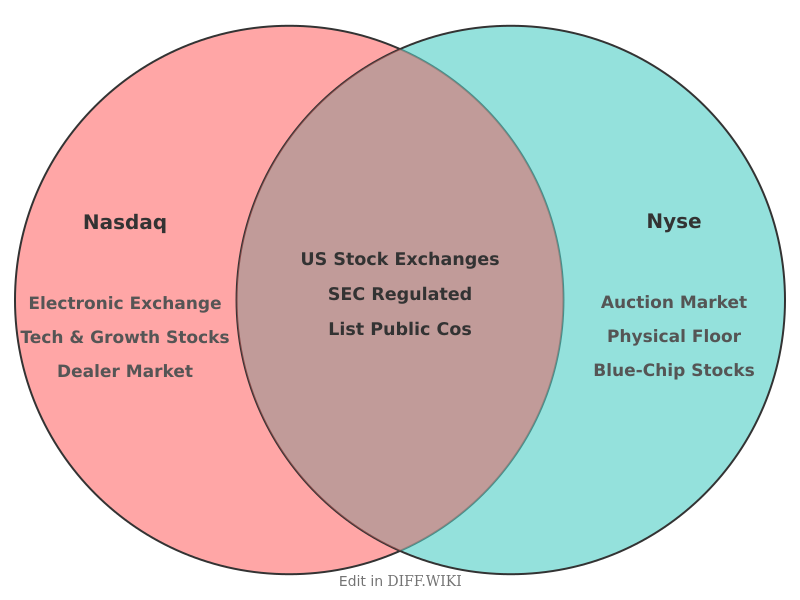

The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations) and the New York Stock Exchange (NYSE) are the two largest stock exchanges in the United States and the world by market capitalization.[1] While both are based in New York City and facilitate the trading of securities, they differ in their history, operational structure, and the types of companies they typically list.[2] The NYSE, established in 1792, is the older of the two and has historically been associated with more established, blue-chip companies.[1][3][4][5] In contrast, the Nasdaq, founded in 1971, was the world's first electronic stock market and is known for its concentration of technology and high-growth firms.

Comparison Table[edit]

| Category | NASDAQ | NYSE |

|---|---|---|

| Founded | 1971 | 1792[4][5] |

| Market Model | Dealer market[1][2] | Auction market[1][2] |

| Trading Mechanism | Fully electronic[1][2] | Hybrid model (physical trading floor and electronic)[3] |

| Typical Listed Companies | Technology, biotechnology, and growth-oriented companies[1][2][3] | Blue-chip, industrial, and established companies[1][2] |

| Number of Listings | Over 3,300[1] | Around 2,800[1] |

| Listing Fees | Generally lower, with fees typically capped around $159,000[1] | Generally higher, with fees that can reach up to $500,000[1] |

| Market Makers | Multiple market makers per stock[2][3] | One Designated Market Maker (DMM) per stock[1][3] |

Market Structure and Trading[edit]

A primary distinction between the two exchanges lies in their market structure. The NYSE operates as an auction market, where buyers and sellers submit competitive bids.[1] A Designated Market Maker (DMM) for each stock facilitates trading on the floor, aiming to maintain a fair and orderly market.[1][3] This system involves both human interaction on a physical trading floor and electronic trading.[3]

Conversely, the Nasdaq is a dealer market, where trades are executed through multiple "market makers" who are responsible for holding an inventory of a particular stock.[1] These market makers continuously provide buy and sell prices, and transactions occur electronically through a network of dealers rather than direct interaction between buyers and sellers.[1] This structure makes the Nasdaq a fully electronic exchange with no physical trading floor.[2]

Listed Companies and Requirements[edit]

The types of companies listed on each exchange also tend to differ. The NYSE has traditionally been the exchange for larger, more established "blue-chip" and industrial corporations.[1][2] Its listing requirements are generally considered more stringent, often requiring a history of profitability.

The Nasdaq is widely known as a hub for technology and innovative growth companies, listing giants such as Apple, Microsoft, and Amazon.[1][2] While it also lists large corporations, its listing requirements can be more flexible, making it a more accessible option for newer, smaller companies, particularly in the tech and biotech sectors. Consequently, listing fees on the Nasdaq are generally lower than on the NYSE.[1]

References[edit]

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 1.12 1.13 1.14 1.15 1.16 1.17 1.18 "carpenterwellington.com". Retrieved January 04, 2026.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 "investopedia.com". Retrieved January 04, 2026.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 "smartasset.com". Retrieved January 04, 2026.

- ↑ 4.0 4.1 "nyse.com". Retrieved January 04, 2026.

- ↑ 5.0 5.1 "britannica.com". Retrieved January 04, 2026.