Differences between Qualified and Non-qualified Stock Options

Contents

Differences between Qualified and Non-qualified Stock Options[edit]

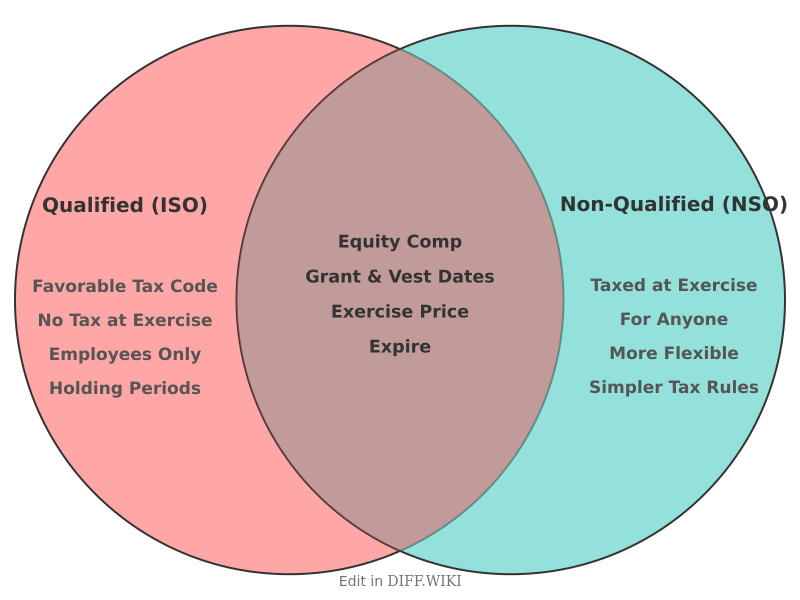

Stock options are a form of equity compensation that allows an individual to purchase a company's stock at a predetermined price. There are two main types of stock options: qualified and non-qualified. The primary distinction between them lies in their tax treatment under the Internal Revenue Code.[1][2][3]

Qualified stock options, also known as incentive stock options (ISOs), meet specific requirements set by the IRS, which can result in preferential tax treatment.[1][2][4] Non-qualified stock options (NSOs), on the other hand, do not meet these requirements and are therefore not afforded the same tax advantages.[5][2]

Comparison Table[edit]

| Category | Qualified Stock Options (ISOs) | Non-qualified Stock Options (NSOs) |

|---|---|---|

| Taxation at Exercise | No regular income tax is due at the time of exercise. However, the difference between the fair market value of the stock and the exercise price is considered for the Alternative Minimum Tax (AMT). | The difference between the fair market value of the stock and the exercise price is taxed as ordinary income. This is subject to federal, Social Security, and Medicare taxes. |

| Taxation at Sale | If holding period requirements are met (held for at least two years from the grant date and one year from the exercise date), the profit is taxed as a long-term capital gain. | Any appreciation in value from the time of exercise to the time of sale is taxed as a capital gain (short-term or long-term depending on the holding period after exercise).[5] |

| Eligibility | Can only be granted to employees.[4] | Can be granted to employees, directors, consultants, and independent contractors. |

| Holding Period Requirements | To receive preferential tax treatment, the stock must be held for at least two years from the grant date and one year from the exercise date. | There are no specific holding period requirements to exercise the options. |

| Exercise Price | The exercise price must be equal to or greater than the fair market value of the stock on the grant date.[2] For significant shareholders (owning more than 10%), the exercise price must be at least 110% of the fair market value. | The exercise price can be set below, at, or above the fair market value of the stock on the grant date.[2] |

| Company Tax Deduction | The company does not receive a tax deduction unless there is a disqualifying disposition (i.e., the holding period requirements are not met). | The company can take a tax deduction on the amount the employee reports as ordinary income upon exercising the options. |

Taxation Details[edit]

With qualified stock options (ISOs), an employee generally does not recognize any taxable income upon grant or exercise of the option for regular tax purposes. The taxable event occurs when the stock is sold. If the sale meets the holding period requirements, the entire gain is taxed at the more favorable long-term capital gains rate. However, the "bargain element" (the difference between the fair market value at exercise and the exercise price) is an adjustment item for the Alternative Minimum Tax (AMT), which can potentially lead to a tax liability in the year of exercise.[3]

For non-qualified stock options (NSOs), the holder is taxed at the time of exercise. The bargain element is treated as ordinary income and is subject to withholding for income and employment taxes. When the shares are later sold, any further appreciation is treated as a capital gain. The capital gains tax will be either short-term or long-term, depending on how long the shares were held after the exercise date.[5]

Eligibility and Other Requirements[edit]

Incentive stock options are restricted to employees of the company.[4] Non-qualified stock options can be offered to a broader group, including non-employee directors, consultants, and contractors.

ISOs are also subject to other regulations, such as a requirement that they be granted under a formal written plan approved by shareholders. There is also a $100,000 annual limit on the value of ISOs that can become exercisable for the first time for any employee. Any amount over this limit is treated as an NSO.[4]