Differences between Depression and Recession

Comparison Article[edit]

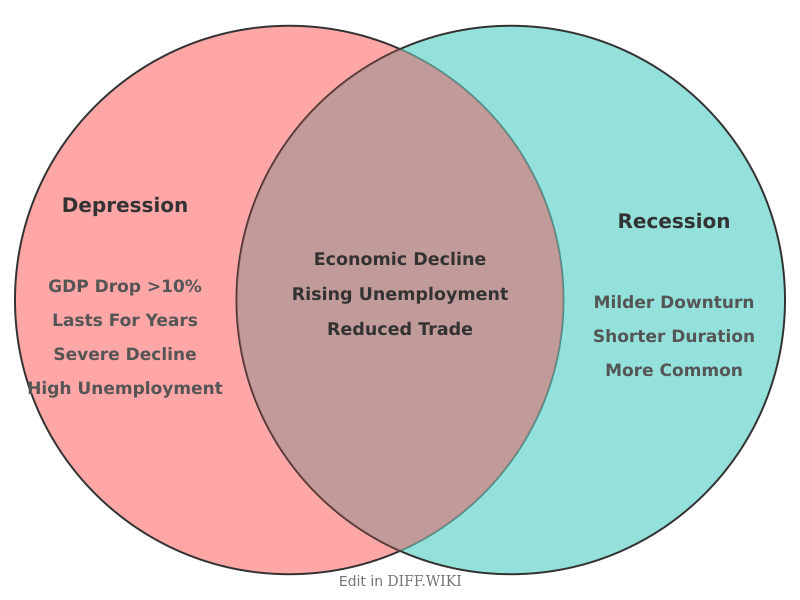

In economics, recessions and depressions both describe periods of economic downturn, but they differ significantly in severity, duration, and overall impact. A depression is essentially a more severe and prolonged recession.[1] While there is no universally agreed-upon formal definition for a depression, a recession has a more specific, though still flexible, definition.[1][2]

In the United States, the National Bureau of Economic Research (NBER) defines a recession as "a significant decline in economic activity that is spread across the economy and lasts more than a few months."[3] This determination is based on multiple factors, including real GDP, real income, employment, and industrial production.[1][3] A popular rule of thumb often cited by journalists is two consecutive quarters of negative GDP growth, though this is not the official definition used by economists.[1][4]

A depression is a much deeper and longer-lasting downturn.[5] While the NBER does not officially declare depressions, some economists suggest informal criteria, such as a decline in real GDP exceeding 10 percent, or a recession lasting for more than two years. The effects of a depression are far more pronounced than those of a recession, characterized by widespread unemployment, a severe drop in industrial production, and major reductions in international trade.

Comparison Table[edit]

| Category | Recession | Depression |

|---|---|---|

| Definition | A significant decline in economic activity across the economy lasting more than a few months, as determined by the NBER. | A severe and prolonged economic downturn; no official definition exists, but it is a much deeper contraction than a recession.[1][5] |

| GDP Decline | Typically a modest decline. The 2007-2009 Great Recession saw a 4.3% drop in real GDP. | A substantial decline, often cited as 10% or more. U.S. GDP fell by about 30% during the Great Depression. |

| Duration | Varies, but typically lasts from a few months to over a year. The Great Recession lasted 18 months. | A sustained downturn lasting for several years. The Great Depression lasted about a decade, from 1929 to 1939. |

| Unemployment Rate | Rises, but to a lesser extent. The unemployment rate peaked at 10% during the Great Recession. | Rises to extreme levels. During the Great Depression, unemployment in the U.S. exceeded 20%, peaking at nearly 25%. |

| Impact on Commerce | Widespread slowdown in production and sales.[1] | A sharp reduction in industrial production and international trade. Industrial production in the U.S. fell by nearly 47% from 1929 to 1933. |

| Credit and Banking | Credit can become tighter. | Often characterized by banking panics and a significant reduction in available credit. Thousands of U.S. banks failed in the early 1930s. |

| Historical U.S. Example | The Great Recession (December 2007 – June 2009). | The Great Depression (1929 – c. 1939). |

The key distinction lies in the magnitude of the economic collapse. A recession is a normal, albeit painful, part of the business cycle. A depression,[5] however, is a rare and catastrophic event with devastating and long-lasting consequences for society, including widespread bankruptcies, currency failures, and a significant drop in living standards. The United States has experienced only one event widely classified as a depression in its modern history.

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 "frbsf.org". Retrieved January 10, 2026.

- ↑ "nber.org". Retrieved January 10, 2026.

- ↑ 3.0 3.1 "congress.gov". Retrieved January 10, 2026.

- ↑ "mit.edu". Retrieved January 10, 2026.

- ↑ 5.0 5.1 5.2 "experian.com". Retrieved January 10, 2026.