Differences between Capital Lease and Operating Lease

Contents

Capital Lease vs. Operating Lease[edit]

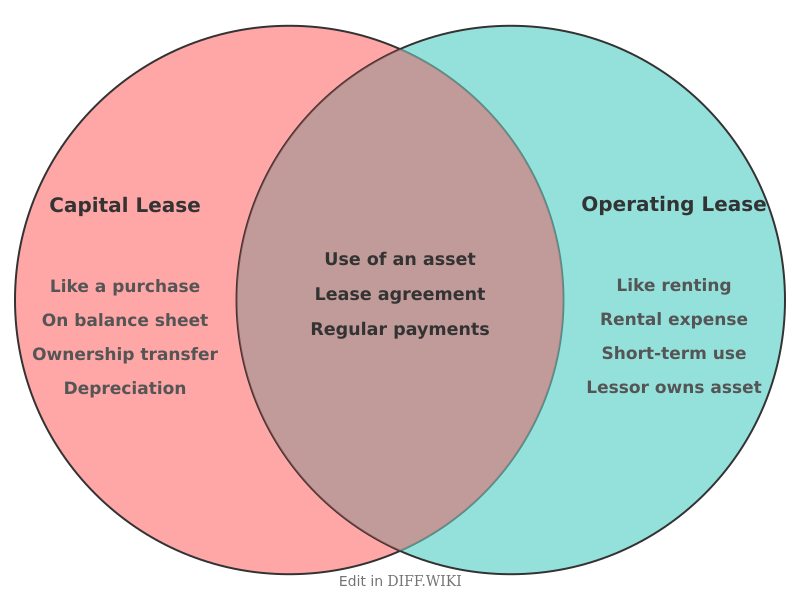

A lease is a contractual agreement where a lessor permits a lessee to use an asset for a specific period in exchange for payments.[1] Leases are primarily classified into two types under U.S. Generally Accepted Accounting Principles (GAAP): capital leases and operating leases.[2] A capital lease, now referred to as a finance lease under the ASC 842 standard, is a long-term agreement that transfers most of the risks and rewards of ownership to the lessee.[3][4] In contrast, an operating lease is a contract for the use of an asset without transferring ownership rights.[5]

The classification of a lease is significant as it dictates the accounting treatment and how the transaction is reflected on a company's financial statements.[4] A key change with the adoption of ASC 842 is that both operating and finance leases for terms longer than 12 months must be recognized on the balance sheet, which increases financial transparency.[5] This differs from previous guidance where operating leases were often treated as off-balance-sheet financing. The International Financial Reporting Standards (IFRS) 16 has a single lessee accounting model, treating all lessee leases as finance leases.[1]

A lease is classified as a finance lease if it meets at least one of five specific criteria that suggest the lessee is effectively purchasing the asset.[2] These criteria include the transfer of ownership to the lessee at the end of the lease, an option for the lessee to purchase the asset that they are reasonably certain to exercise, a lease term that covers the major part of the asset's economic life, or the present value of lease payments amounting to substantially all of the asset's fair value. A fifth criterion considers whether the asset is so specialized that it has no alternative use to the lessor after the lease term.[4] If none of these conditions are met, the lease is classified as an operating lease.[4]

Comparison Table[edit]

| Category | Capital Lease (Finance Lease) | Operating Lease |

|---|---|---|

| Ownership | Transfers substantially all risks and rewards of ownership to the lessee.[3] The lease may include a transfer of title or a bargain purchase option. | The lessor retains ownership of the asset. The lessee only has the right to use the asset for the lease term.[5] |

| Balance Sheet Impact | The lessee records a right-of-use (ROU) asset and a corresponding lease liability on the balance sheet. This can increase the company's reported debt ratios. | Under ASC 842, the lessee also records a right-of-use (ROU) asset and a lease liability on the balance sheet. |

| Expense Recognition | The lessee recognizes amortization expense on the ROU asset and interest expense on the lease liability separately on the income statement.[2] | The lessee recognizes a single lease expense, which is typically recorded on a straight-line basis over the lease term. |

| Cash Flow Statement | Payments are split between principal repayments (financing activities) and interest payments (operating activities).[2] | All lease payments are generally classified as operating activities.[2] |

| Lease Term | The term typically covers a major part (generally 75% or more) of the asset's economic life. | The term is generally for a shorter period, not covering the majority of the asset's useful life. |

| End of Term | The lessee may gain ownership of the asset or have an option to purchase it at a price significantly below market value.[1] | The lessee returns the asset to the lessor at the end of the term. |

Accounting Treatment[edit]

Under a capital lease, the transaction is treated as a financed purchase of the asset. The lessee capitalizes the lease by recording an asset and a liability at the present value of the future lease payments. The income statement reflects both depreciation expense on the asset and interest expense on the liability.

For an operating lease under ASC 842, a right-of-use asset and a lease liability are also recorded on the balance sheet. However, the income statement shows a single lease expense, combining interest and amortization, which is allocated evenly over the life of the lease. This results in a different expense recognition pattern compared to a capital lease, where total expenses are typically higher in the earlier years of the lease.

References[edit]

- ↑ 1.0 1.1 1.2 "gelmanllp.com". Retrieved January 15, 2026.

- ↑ 2.0 2.1 2.2 2.3 2.4 "tangoanalytics.com". Retrieved January 15, 2026.

- ↑ 3.0 3.1 "barneswalker.com". Retrieved January 15, 2026.

- ↑ 4.0 4.1 4.2 4.3 "finquery.com". Retrieved January 15, 2026.

- ↑ 5.0 5.1 5.2 "investopedia.com". Retrieved January 15, 2026.