Differences between Deed Of Trust and Mortgage

Deed of Trust vs. Mortgage[edit]

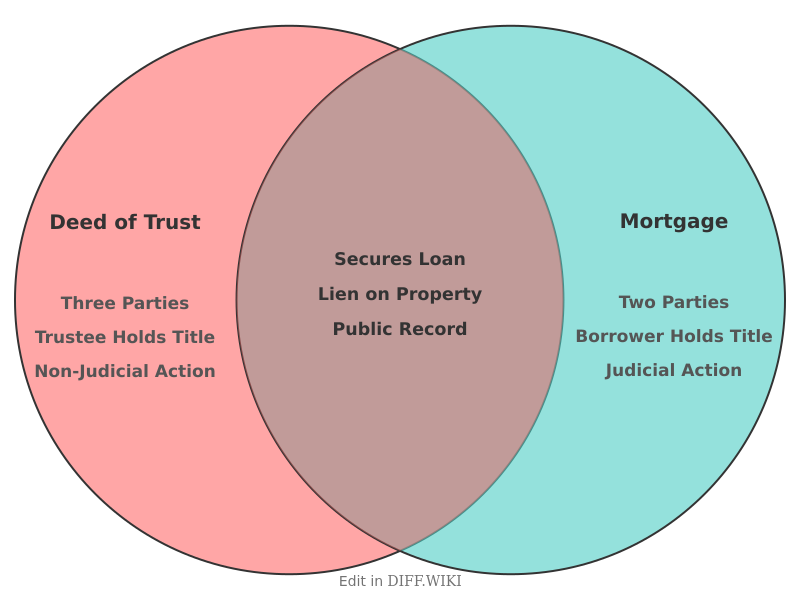

A deed of trust and a mortgage are both legal instruments used in real estate transactions to secure a loan, using the property as collateral.[1] While they serve a similar function, key differences exist regarding the parties involved, the foreclosure process, and who holds legal title to the property.[2][3][1] The use of one over the other is typically determined by state law.[4][5]

In a mortgage agreement, there are two parties: the borrower (mortgagor) and the lender (mortgagee). The borrower receives a loan and in return, the lender holds a lien on the property. Should the borrower default on the loan, the lender must typically go through a judicial foreclosure process, which involves filing a lawsuit and obtaining a court order to sell the property.

A deed of trust, on the other hand, involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party known as the trustee.[4] The trustee, often a title or escrow company, holds the legal title to the property on behalf of the lender until the loan is fully repaid.[5] If the borrower defaults, the lender can instruct the trustee to initiate a non-judicial foreclosure. This process is generally faster and less expensive than a judicial foreclosure as it does not require court involvement.[1]

Upon full repayment of the loan, in a deed of trust arrangement, the trustee reconveys the legal title to the borrower through a document called a deed of reconveyance, extinguishing the lender's security interest. In a mortgage, the lender provides a satisfaction of mortgage document, which removes the lien from the property.

Comparison Table[edit]

| Category | Deed Of Trust | Mortgage |

|---|---|---|

| Parties Involved | Three: Borrower (Trustor), Lender (Beneficiary), and Trustee | Two: Borrower (Mortgagor) and Lender (Mortgagee) |

| Holding of Title | A third-party trustee holds legal title to the property until the loan is paid off.[5] | The borrower holds the title to the property, while the lender has a lien on it. |

| Foreclosure Process | Typically a non-judicial process, which is generally faster and does not involve the court system.[1] | Usually requires a judicial process, meaning the lender must go through the courts to foreclose. |

| Governing Document | Deed of Trust[4] | Mortgage Agreement |

| State Usage | Used exclusively in some states and permitted alongside mortgages in others. Lenders often prefer it for the faster foreclosure process. | Required in states that do not use or permit deeds of trust.[1] |

| Loan Repayment Completion | The trustee issues a deed of reconveyance to the borrower. | The lender provides a satisfaction of mortgage to the borrower. |

The choice between a deed of trust and a mortgage is dictated by state law.[1] Some states exclusively use deeds of trust, some only use mortgages, and others permit the use of both, leaving the choice to the lender.[1] Lenders in states that allow both often prefer deeds of trust due to the more streamlined foreclosure process in the event of default.

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 "smartasset.com". Retrieved January 20, 2026.

- ↑ "nolo.com". Retrieved January 20, 2026.

- ↑ "lendingtree.com". Retrieved January 20, 2026.

- ↑ 4.0 4.1 4.2 "rocketmortgage.com". Retrieved January 20, 2026.

- ↑ 5.0 5.1 5.2 "quickenloans.com". Retrieved January 20, 2026.