Differences between Ask Price and Bid Price

Ask Price vs. Bid Price[edit]

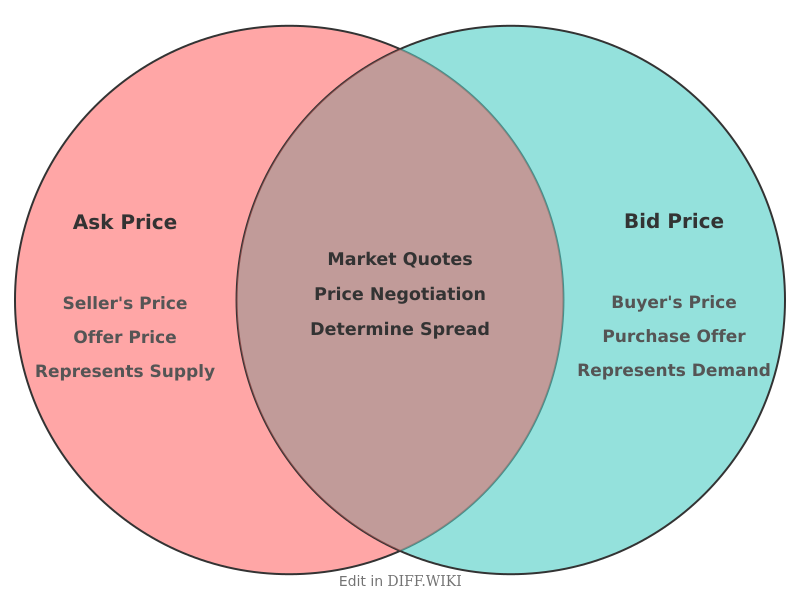

In financial markets, the terms ask price and bid price are fundamental concepts in the trading of assets such as stocks, bonds, and currencies.[1][2] The ask price, also referred to as the "offer price," represents the minimum price at which a seller is willing to sell a security.[3] Conversely, the bid price is the maximum price that a buyer is willing to pay for that same security.[4] An investor looking to purchase an asset will pay the ask price, while an investor looking to sell an asset will receive the bid price.[5]

The bid price will almost always be lower than the ask price.[1] This difference between the two is known as the bid-ask spread.[1] The spread is a key indicator of a security's liquidity and represents a transaction cost for investors. A narrow spread typically signifies high liquidity, meaning the asset is actively traded, while a wider spread can indicate lower liquidity.[5]

Market makers, which are often financial institutions or high-frequency trading firms, play a crucial role in providing liquidity by simultaneously quoting both bid and ask prices. They profit from the bid-ask spread by buying at the bid price and selling at the ask price.[5]

Comparison Table[edit]

| Category | Ask Price | Bid Price |

|---|---|---|

| The price a seller is willing to accept.[1][3] | The price a buyer is willing to pay.[1] | ||

| The price at which an investor can buy a security.[5] | The price at which an investor can sell a security.[5] | ||

| Typically higher than the bid price. | Typically lower than the ask price.[1] | ||

| Represents the supply for a security.[5] | Represents the demand for a security.[5] | ||

| From the seller's or market maker's point of view, it is the price at which they will sell. | From the buyer's point of view, it is the price they are offering. | ||

| If a stock quote is $10.50 / $10.55, the ask price is $10.55. | If a stock quote is $10.50 / $10.55, the bid price is $10.50. |

The Bid-Ask Spread[edit]

The bid-ask spread is the difference between the ask price and the bid price and is a fundamental component of market trading.[1] It is the primary way market makers are compensated for the risk they take and for providing liquidity to the markets.[5] For an investor, the spread is an implicit cost of trading.[5]

The size of the spread can be influenced by several factors. Assets with high trading volume and liquidity, such as large-cap stocks or major currency pairs, tend to have very narrow spreads, sometimes only a few cents or pips.[5] In contrast, assets that are traded less frequently, known as illiquid assets, will have a much wider spread to compensate the market maker for the increased risk of holding a position that may be difficult to sell.[5] Market volatility can also impact the spread; during periods of high volatility, spreads tend to widen as risk for market makers increases.

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 "investor.gov". Retrieved January 21, 2026.

- ↑ "smartasset.com". Retrieved January 21, 2026.

- ↑ 3.0 3.1 "investor.gov". Retrieved January 21, 2026.

- ↑ "investopedia.com". Retrieved January 21, 2026.

- ↑ 5.00 5.01 5.02 5.03 5.04 5.05 5.06 5.07 5.08 5.09 5.10 "equirus.com". Retrieved January 21, 2026.