Differences between MasterCard and Visa

MasterCard vs. Visa

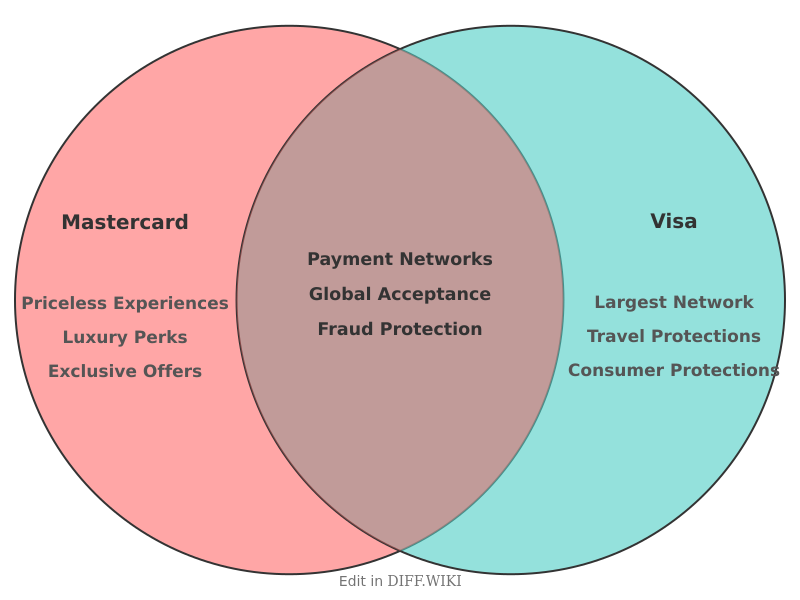

MasterCard and Visa are two of the largest payment processing networks in the world.[1] They operate the networks that allow for electronic fund transfers between banks and merchants.[2] Neither company issues credit or debit cards directly to consumers.[1] Instead, financial institutions like banks and credit unions issue cards that operate on one of these networks.[1] The interest rates, fees, and rewards associated with a card are determined by the issuing institution, not by MasterCard or Visa.[3][4] Together, the two companies process over 90% of global payment transactions outside of China.[5]

For consumers, there is little practical difference between MasterCard and Visa.[3] Both are accepted at millions of merchants worldwide, and the acceptance of one almost always means the acceptance of the other.[3] Some retailers may have exclusive agreements with one network, such as Costco's acceptance of only Visa cards in the United States.[3]

Comparison Table

| Category | MasterCard | Visa |

|---|---|---|

| Business Model | Operates a payment processing network. Generates revenue from service fees charged to financial institutions.[5] | Operates a payment processing network. Generates revenue from service and transaction fees charged to financial institutions.[5] |

| Global Acceptance | Accepted in over 210 countries and territories.[4] | Accepted in over 200 countries and territories.[5] |

| Market Share | Smaller market share in terms of transaction volume and number of cards in circulation.[1] | Larger market share by transaction volume and number of cards.[1] In 2024, Visa's purchase volume market share was 70.28% compared to Mastercard's 29.72% in the U.S. |

| Card Tiers | Standard, World, and World Elite.[5][3] | Traditional, Signature, and Infinite.[5][3] |

| Security Features | Offers security features such as Mastercard SecureCode and ID Theft Protection. | Provides security measures like Verified by Visa and a Payment Passkey Service using biometrics.[5] Both networks offer zero fraud liability policies. |

| Payment Gateway Services | Offers Mastercard Payment Gateway Services. | Owns CyberSource, a global payment gateway. |

| Real-Time Payments | Provides Mastercard Send for near real-time fund transfers. | Offers Visa Direct for near real-time payments. |

Additional Services

Beyond basic transaction processing, both companies have expanded into other areas of digital payments. Visa's CyberSource and Mastercard's Payment Gateway Services provide merchants with the infrastructure to accept online payments. These gateways act as intermediaries between the merchant and the payment processor, securely transmitting transaction information.

Both networks also offer services for near real-time fund transfers, known as Visa Direct and Mastercard Send. These services enable person-to-person payments, business-to-consumer disbursements, and other applications where faster fund availability is necessary, with transactions often settling in under 30 minutes.

The benefits associated with a particular card, such as travel insurance or rewards programs, are primarily determined by the issuing bank and the card's tier level (e.g., Standard vs. World Elite).[3][4] Higher-tier cards from both networks generally offer more comprehensive benefits.[5][4]

References

- ↑ 1.0 1.1 1.2 1.3 1.4 "investopedia.com". Retrieved January 23, 2026.

- ↑ "reddit.com". Retrieved January 23, 2026.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 "nerdwallet.com". Retrieved January 23, 2026.

- ↑ 4.0 4.1 4.2 4.3 "wellsfargo.com". Retrieved January 23, 2026.

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 5.6 5.7 "swipesum.com". Retrieved January 23, 2026.