Differences between Financial Accounting and Management Accounting

Contents

Financial Accounting vs. Management Accounting

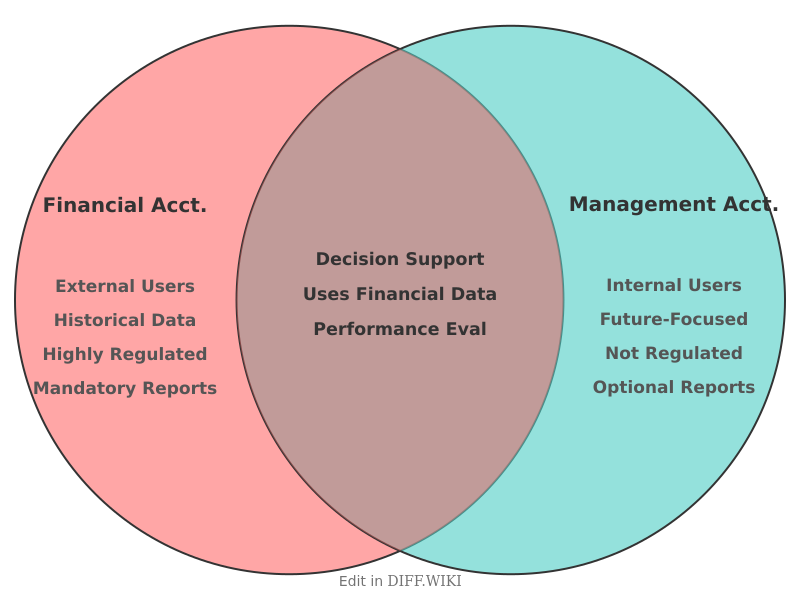

Financial accounting and management accounting are two distinct branches of the accounting discipline, each serving different purposes and audiences.[1] Financial accounting is primarily concerned with the recording and reporting of a company's financial transactions to external stakeholders.[2] In contrast, management accounting, also known as managerial accounting, focuses on providing financial information to a company's internal management to aid in decision-making and performance improvement.[3] While both utilize fundamental accounting data, their objectives, the users of their information, and the regulatory environments they operate in are fundamentally different.

Comparison Table

| Category | Financial Accounting | Management Accounting |

|---|---|---|

| Primary Users | External parties such as investors, creditors, and government agencies.[4] | Internal management and employees of the organization.[5] |

| Purpose of Information | To provide a standardized overview of the company's financial health and performance for making investment and credit decisions. | To assist internal managers in planning, decision-making, and controlling business operations. |

| Time Focus | Primarily historical, focusing on past transactions and events.[4] | Forward-looking, with an emphasis on future forecasts and budgets. |

| Rules and Regulations | Must adhere to strict standards like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). | Flexible and not bound by external standards; tailored to the specific needs of management. |

| Scope of Information | Focuses on the overall financial performance of the entire organization. | Provides detailed and segmented information on specific departments, products, or activities. |

| Frequency of Reporting | Typically reported on a periodic basis, such as quarterly or annually. | Reports are generated as needed by management, which can be daily, weekly, or monthly.[1] |

Key Distinctions

The primary distinction between financial and management accounting lies in their target audience. Financial accounting creates reports for those outside the organization, including investors, lenders, suppliers, and government bodies. These external users require standardized and comparable financial statements, such as the income statement, balance sheet, and cash flow statement, to assess the company's financial position and performance.

Management accounting, on the other hand, is tailored for internal use by managers at various levels within an organization. The information provided by management accountants is used for strategic planning, performance evaluation, cost control, and other internal decision-making processes.[3] This information is often more detailed and specific than the data presented in external financial reports and can focus on individual departments, products, or projects.

Another significant difference is the regulatory framework. Financial accounting is highly regulated to ensure consistency and transparency. Companies must follow established principles like GAAP in the United States or IFRS in many other countries.[2] These standards dictate how financial transactions are recorded and presented. In contrast, management accounting is not subject to such strict external rules. Reports can be customized to meet the specific needs of management, allowing for greater flexibility in the type of information presented.

The time orientation of the two disciplines also differs. Financial accounting is predominantly historical, reporting on transactions that have already occurred. While this information can be used to make future predictions, its primary focus is on the past. Management accounting, however, is more forward-looking.[2] It often involves creating budgets, forecasts, and other projections to help guide future business activities and decisions.[3]

References

- ↑ 1.0 1.1 "enerpize.com". Retrieved January 26, 2026.

- ↑ 2.0 2.1 2.2 "icaew.com". Retrieved January 26, 2026.

- ↑ 3.0 3.1 3.2 "snhu.edu". Retrieved January 26, 2026.

- ↑ 4.0 4.1 "investopedia.com". Retrieved January 26, 2026.

- ↑ "lumenlearning.com". Retrieved January 26, 2026.