Differences between ETF and Mutual Fund

Contents

ETF vs. Mutual Fund

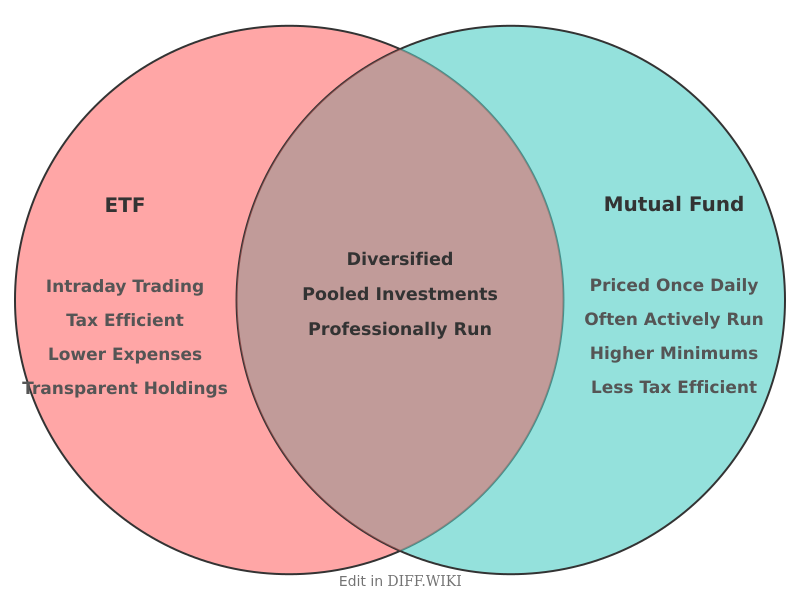

An exchange-traded fund (ETF) and a mutual fund are both types of investment funds that pool money from many investors to purchase a diversified collection of securities, such as stocks and bonds.[1][2] Both are managed by professional portfolio managers and offer a way to achieve diversification more easily than by buying individual securities.[1] However, there are key differences in how they are structured, traded, and taxed.

Comparison Table

| Category | ETF | Mutual Fund |

|---|---|---|

| Trading | Traded on stock exchanges throughout the day at fluctuating market prices.[3][4] | Bought and sold directly from the fund company at the net asset value (NAV) calculated once at the end of the trading day.[3][5] |

| Pricing | Priced continuously during the trading day, with its market price potentially differing from its NAV. | Priced once per day at the close of the market based on the NAV of the fund's holdings.[2][5] |

| Management Style | Mostly passively managed, designed to track a specific market index.[3][2] Actively managed options are also available. | Predominantly actively managed, with the goal of outperforming a market benchmark.[4][2] Index mutual funds also exist.[1] |

| Expense Ratios | Generally have lower expense ratios, particularly for passively managed funds.[3][2] | Typically have higher expense ratios due to active management and other operational costs.[3] |

| Tax Efficiency | Often more tax-efficient due to their in-kind creation and redemption process, which can minimize capital gains distributions. | Can be less tax-efficient as the fund manager's buying and selling of securities can generate capital gains that are passed on to shareholders.[2] |

| Minimum Investment | The minimum investment is typically the price of a single share.[4] | Often require a minimum initial investment, which can be a set dollar amount.[1][4] |

| Transparency | Holdings are typically disclosed on a daily basis. | Holdings are generally disclosed on a quarterly or semi-annual basis. |

Trading and Pricing

The most significant difference between ETFs and mutual funds lies in how they are traded. ETFs are bought and sold on a stock exchange, similar to individual stocks.[4] This allows for intraday trading, where prices can fluctuate throughout the day based on supply and demand.[2] Investors can also use various order types, such as limit and stop orders, when trading ETFs.

In contrast, mutual fund shares are purchased from and sold back to the fund company itself.[3] All transactions are executed at the net asset value (NAV) of the fund, which is calculated at the end of each trading day. This means that all investors who buy or sell a mutual fund on a given day do so at the same price, regardless of when they placed their order.[4]

Structure and Tax Implications

ETFs have a unique creation and redemption process involving authorized participants (APs), who are large financial institutions. This "in-kind" transfer of securities helps to minimize the realization of capital gains within the fund, often making ETFs more tax-efficient than mutual funds. When an investor sells ETF shares, they are typically selling to another investor on the exchange, so the fund itself does not have to sell its underlying securities.[1]

When a mutual fund investor sells their shares, the fund manager may need to sell some of the fund's holdings to raise cash for the redemption.[2] This can trigger capital gains for the fund, which are then distributed to the remaining shareholders, creating a taxable event.

Costs and Management

ETFs, particularly those that are passively managed to track an index, tend to have lower expense ratios compared to actively managed mutual funds.[2] Mutual funds often have higher management fees associated with the research and trading activities of the fund manager.[3] Additionally, some mutual funds may charge sales loads or redemption fees, which are less common with ETFs.[4] While most ETFs are index-based, the number of actively managed ETFs has been growing.

References

- ↑ 1.0 1.1 1.2 1.3 1.4 "vanguard.com". Retrieved January 26, 2026.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 "usbank.com". Retrieved January 26, 2026.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 "groww.in". Retrieved January 26, 2026.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 4.6 "schwab.com". Retrieved January 26, 2026.

- ↑ 5.0 5.1 "investor.gov". Retrieved January 26, 2026.