Differences between Bubble and Ponzi Scheme

Bubble vs. Ponzi Scheme

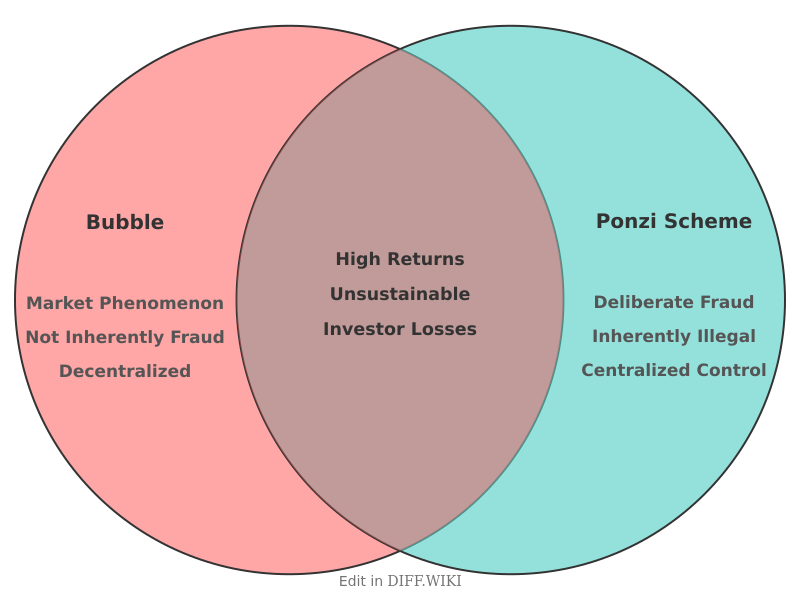

An economic bubble and a Ponzi scheme both involve unsustainable financial structures where participants' returns are dependent on a continuous flow of new money.[1] However, a key distinction lies in their intent and mechanics. A Ponzi scheme is a deliberate form of investment fraud where returns are paid to earlier investors using capital from newer investors, rather than from legitimate investment profits.[2][3] In contrast, an economic bubble occurs when the price of an asset rises to a level far exceeding its intrinsic value, driven by exuberant market behavior rather than a centralized deception.[4]

A Ponzi scheme is inherently illegal, as it is designed to defraud people through deceit.[5] Bubbles, on the other hand, are not illegal in themselves and can arise from genuine, albeit misguided, market optimism.[1] The deception in a Ponzi scheme is explicit and central to its operation, with organizers misleading investors about the source of their profits. In most bubbles, there is no single entity misrepresenting the asset's value; instead, prices are driven by the collective belief that they will continue to rise, a concept often referred to as the "greater fool" theory.[1]

The collapse of a Ponzi scheme is inevitable, occurring when the operator can no longer attract enough new investors to pay the returns promised to existing ones, or when a significant number of investors attempt to cash out.[2] The end of an economic bubble, often called a crash, happens when investor confidence wanes, leading to a rapid sell-off and a sharp decline in the asset's price.[4] While assets in a collapsed bubble may retain some residual value, investments in a failed Ponzi scheme are typically worthless.[1]

Comparison Table

| Category | Bubble | Ponzi Scheme |

|---|---|---|

| Nature | A market phenomenon where asset prices exceed their fundamental value due to speculation.[4] | A fraudulent investment operation that pays returns to investors from their own money or money paid by subsequent investors. |

| Intent | Not inherently fraudulent; driven by collective investor optimism and speculation.[1] | Deliberately fraudulent from the outset, orchestrated by a central operator.[5] |

| Legality | Generally not illegal, though specific manipulative practices within a bubble can be. | Inherently illegal as a form of investment fraud.[5] |

| Mechanism | Prices are driven up by market demand and the belief that they will continue to rise.[1] | Returns are generated by a continuous flow of new investment capital, not from actual profits. |

| Source of Returns | Theoretically from the underlying value and future growth potential of the asset, although speculative. | Funds from new investors are used to pay earlier investors. |

| Central Control | Typically decentralized with no single individual or group controlling the price inflation.[1] | Centralized, with one or a few individuals orchestrating the scheme. |

| Transparency | Price and trading information are often public, though the intrinsic value is debated. | Operations are secretive, and the investment strategy is often vaguely described as complex or proprietary. |

| Collapse Trigger | A shift in market sentiment, leading to panic selling and a price crash.[4] | Inability to attract new investors or a high volume of withdrawal requests. |

| Post-Collapse Value | The underlying asset usually retains some value.[1] | Investments become worthless or nearly worthless.[1] |

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 "wikipedia.org". Retrieved February 03, 2026.

- ↑ 2.0 2.1 "cornell.edu". Retrieved February 03, 2026.

- ↑ "utah.gov". Retrieved February 03, 2026.

- ↑ 4.0 4.1 4.2 4.3 "investopedia.com". Retrieved February 03, 2026.

- ↑ 5.0 5.1 5.2 "wikipedia.org". Retrieved February 03, 2026.