Differences between 401k- and IRA

Contents

401(k) vs. IRA[edit]

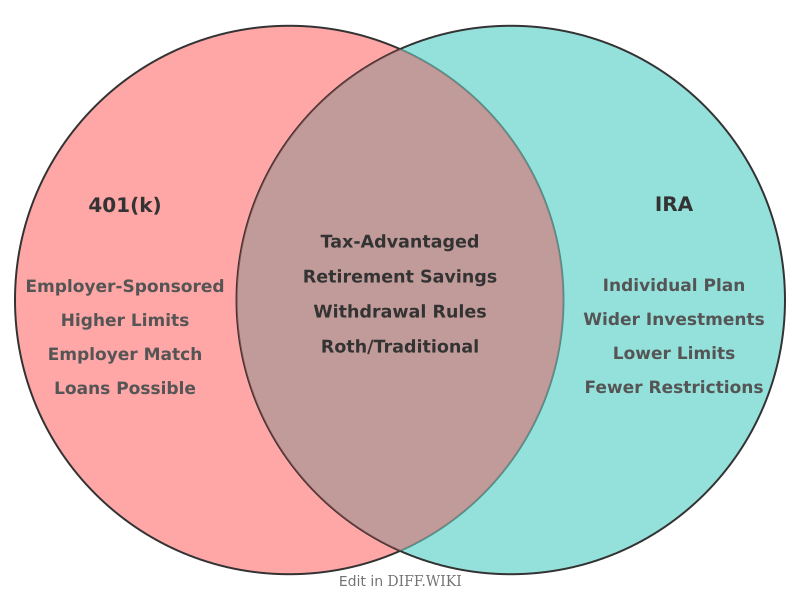

A 401(k) and an Individual Retirement Arrangement (IRA) are both tax-advantaged retirement savings plans in the United States, but they differ in several key aspects.[1] A 401(k) is an employer-sponsored plan, meaning it is only available to employees of companies that offer them.[1][2] In contrast, anyone with earned income can open an IRA through a financial institution like a bank or brokerage firm.[2][3]

Both types of accounts offer tax advantages. With traditional 401(k)s and traditional IRAs, contributions may be tax-deductible, and the investments grow tax-deferred.[1] This means taxes are not paid until the money is withdrawn in retirement. Roth versions of both 401(k)s and IRAs are also available, where contributions are made with after-tax dollars, and qualified withdrawals in retirement are tax-free.[4]

Generally, 401(k)s allow for higher annual contribution limits than IRAs.[1][5] For 2024, the contribution limit for a 401(k) is $23,000 for individuals under 50, with an additional $7,500 catch-up contribution allowed for those 50 and over. For the same year, the IRA contribution limit is $7,000 for those under 50, with a $1,000 catch-up contribution for individuals 50 and older. Many employers who offer a 401(k) also provide a matching contribution, which is a significant benefit not available with IRAs.[2][5]

Comparison Table[edit]

| Category | 401(k) | IRA |

|---|---|---|

| Eligibility | Must be offered by an employer.[1][2] | Anyone with earned income (or a spouse with earned income) can open one.[1] |

| Contribution Limits (2024) | $23,000 ($30,500 for age 50+). | $7,000 ($8,000 for age 50+). |

| Employer Contributions | Employers may offer matching contributions.[2] | No employer match.[2][5] |

| Investment Options | Limited to a selection of funds chosen by the employer.[2][5] | A wide range of options, including stocks, bonds, and mutual funds.[2][5] |

| Loans | Plans may permit loans of up to 50% of the vested balance, capped at $50,000.[1] | Loans are not permitted.[2] |

| Early Withdrawal Exceptions | Fewer exceptions for penalty-free withdrawals before age 59½. [1] | Allows for penalty-free withdrawals for certain expenses like higher education and first-time home purchases (up to $10,000). |

Investment and Withdrawal Differences[edit]

One of the most significant distinctions lies in the investment options available. With a 401(k), participants are limited to the investment choices selected by their employer, which is often a curated list of mutual funds. IRAs[2] typically offer a much broader array of investment choices, including individual stocks, bonds, exchange-traded funds (ETFs), and mutual funds, giving the account holder more control. [2] Withdrawal rules also vary. While both accounts generally impose a 10% penalty for withdrawals before age 59½, IRAs offer more exceptions. For[1] example, traditional IRAs allow for penalty-free withdrawals for qualified higher education expenses and up to $10,000 for a first-time home purchase. Additionally,[1] contributions to a Roth IRA can be withdrawn at any time without tax or penalty. Some[1] 401(k) plans allow participants to take out loans, a feature not available with IRAs. These[2] loans must be repaid with interest, typically within five years.

Rollovers[edit]

It is possible to move funds from a 401(k) to an IRA through a process called a rollover. This[4] is a common practice when an individual leaves a job and wants to consolidate their retirement savings or gain access to more investment options. A direct rollover, where the funds are transferred directly from the 401(k) plan to the IRA custodian, avoids tax withholding. An indirect rollover involves the individual receiving a check, which must then be deposited into the new IRA within 60 days to avoid taxes and penalties.

References[edit]

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 "fidelity.com". Retrieved February 03, 2026.

- ↑ 2.00 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.10 2.11 "citizensbank.com". Retrieved February 03, 2026.

- ↑ "usbank.com". Retrieved February 03, 2026.

- ↑ 4.0 4.1 "usbank.com". Retrieved February 03, 2026.

- ↑ 5.0 5.1 5.2 5.3 5.4 "investopedia.com". Retrieved February 03, 2026.