Differences between AR Financing and PO Financing

AR Financing vs. PO Financing

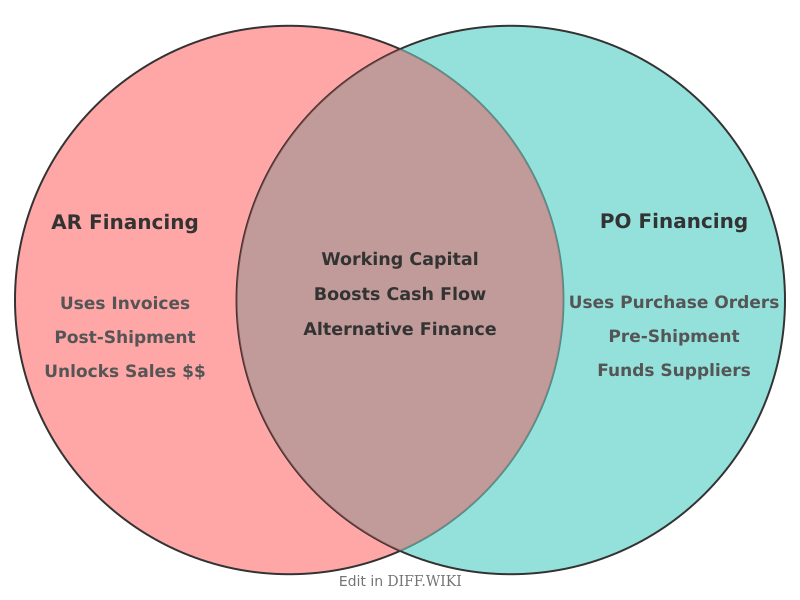

Accounts receivable (AR) financing and purchase order (PO) financing are both forms of short-term funding that can help businesses manage cash flow, though they apply at different stages of the sales cycle.[1][2] AR financing allows a business to get a cash advance on its outstanding invoices for services already rendered or products delivered.[3][4] In contrast, PO financing provides the capital needed to fulfill a customer's purchase order before an invoice is even generated.[5]

With AR financing, a company uses its unpaid invoices as collateral to secure a loan or line of credit. The business typically remains responsible for collecting payment from its customers.[4] PO financing, however, is used to pay suppliers for the goods needed to complete a large order. In this arrangement, the financing company often pays the supplier directly.[5] Once the order is fulfilled and the end customer pays, the financing company deducts its fees and forwards the remaining balance to the business.

The decision between these two financing options often depends on the specific needs of the business. Companies that have completed work but are waiting on customer payments may opt for AR financing to bridge the cash flow gap. Businesses that receive large orders but lack the upfront capital to purchase the necessary materials from suppliers would find PO financing more suitable.

Comparison Table

| Category | AR Financing | PO Financing |

|---|---|---|

| Timing | Occurs after goods or services have been delivered and an invoice is issued. | Occurs before goods are produced or delivered, upon receipt of a customer purchase order. |

| Purpose | To accelerate cash flow by accessing funds tied up in unpaid invoices. | To fund the production or acquisition of goods needed to fulfill a large customer order.[5] |

| Collateral | The company's outstanding invoices (accounts receivable).[3] | The purchase order itself serves as a primary form of security. |

| Use of Funds | Funds can typically be used for any business expense, such as payroll or operational costs. | Funds are restricted and are used specifically to pay the supplier for the goods in the purchase order. |

| Risk for Lender | Lower risk, as it's based on a confirmed debt (invoice) from a customer. | Higher risk, as it depends on the supplier's ability to produce and deliver the goods as ordered. |

| Typical Cost | Generally less expensive, with fees often ranging from 1-4%. | Typically more expensive due to higher risk, with fees ranging from 1.8% to 6% per month.[5] |

| Business Type | Suitable for a wide range of businesses, including service-based companies. | Primarily for businesses that sell physical goods, such as wholesalers, distributors, and resellers. |

References

- ↑ "tagcapfunding.com". Retrieved February 09, 2026.

- ↑ "capstonetrade.com". Retrieved February 09, 2026.

- ↑ 3.0 3.1 "tabbank.com". Retrieved February 09, 2026.

- ↑ 4.0 4.1 "lendio.com". Retrieved February 09, 2026.

- ↑ 5.0 5.1 5.2 5.3 "trebuchetfinancial.com". Retrieved February 09, 2026.