Differences between Fast Stochastic and Slow Stochastic

Fast Stochastic vs. Slow Stochastic[edit]

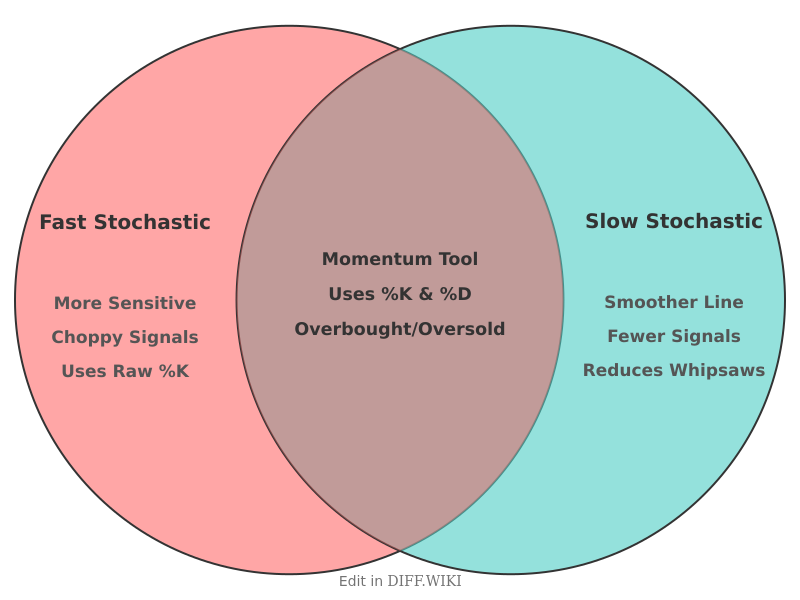

The Stochastic Oscillator is a momentum indicator used in the technical analysis of securities, developed by George C. Lane in the 1950s.[1][2] It compares a security's closing price to its price range over a specific period. The indicator consists of two lines: the %K line and the %D line. The primary distinction lies in their sensitivity to price movements, leading to two common variants: the Fast Stochastic and the Slow Stochastic.[3][4][5]

The Fast Stochastic Oscillator is based on Lane's original formulas.[1] The %K line (fast %K) is calculated directly from the price data, making it highly responsive to price changes.[5] The %D line (fast %D) is a simple moving average (SMA) of the fast %K line, typically over three periods, which smooths the initial %K value slightly.[1] Due to its sensitivity, the Fast Stochastic can produce many trading signals, some of which may be false.[4][5]

The Slow Stochastic Oscillator was developed to address the volatility of the Fast Stochastic.[5] It achieves this by applying additional smoothing. The %K line of the Slow Stochastic (slow %K) is identical to the %D line of the Fast Stochastic. In other words, the fast %K is smoothed once (usually with a 3-period SMA) to create the slow %K.[1] The %D line of the Slow Stochastic (slow %D) is then calculated as a moving average of the slow %K line, adding another layer of smoothing.[1] This process results in a smoother indicator that generates fewer, and often more reliable, trading signals.

Comparison Table[edit]

| Category | Fast Stochastic | Slow Stochastic |

|---|---|---|

| Calculation of %K | Uses the raw calculation comparing the latest close to the recent price range.[1] | Uses the Fast %D line as its %K line (a 3-period SMA of Fast %K).[1] |

| Calculation of %D | A 3-period simple moving average of the Fast %K line.[1] | A 3-period simple moving average of the Slow %K line.[1] |

| Sensitivity | More sensitive to recent price changes.[3][4][5] | Less sensitive due to additional smoothing.[4] |

| Signal Frequency | Generates more trading signals.[3][5] | Generates fewer and more filtered trading signals.[4] |

| Potential for False Signals | Higher potential for false signals or "whipsaws".[4] | Lower potential for false signals due to smoothing. |

| Common Settings | Often represented with two parameters (e.g., 14, 3), representing the %K period and the %D moving average. | Often represented with three parameters (e.g., 14, 3, 3), representing the %K period, the initial smoothing for Slow %K, and the %D moving average. |

Interpretation[edit]

Both oscillators operate on a scale from 0 to 100.[2] Readings above 80 are generally considered to be in the overbought region, suggesting a potential price decline, while readings below 20 are considered oversold, indicating a potential price rise.[2] Trading signals are often generated when the %K line crosses the %D line.[5] A crossover above the %D line can be a buy signal, particularly in oversold territory, while a crossover below the %D line can be a sell signal, especially in overbought territory. Another key use is identifying divergences, where the direction of the price and the oscillator differ, which can signal a potential trend reversal.[2] Because the Slow Stochastic is smoother, traders may find its crossover and divergence signals to be more reliable.

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 "stockcharts.com". Retrieved February 12, 2026.

- ↑ 2.0 2.1 2.2 2.3 "samco.in". Retrieved February 12, 2026.

- ↑ 3.0 3.1 3.2 "elearnmarkets.com". Retrieved February 12, 2026.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 "markets.com". Retrieved February 12, 2026.

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 5.6 "marketpanorama.com". Retrieved February 12, 2026.