Difference Between U.S. GAAP and IFRS

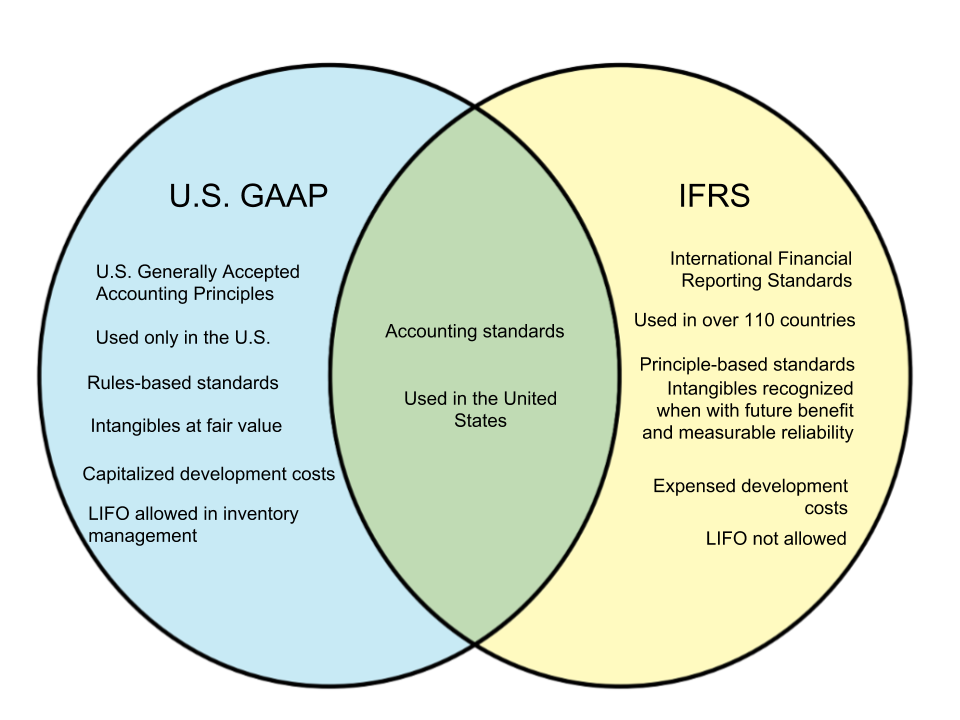

Different countries use different methods of approach in different fields, including accounting. The U.S. GAAP and IFRS are two accounting standards and guidelines that provide a basis for a clear and uniform accounting process. Here, we discuss the differences between the U.S. GAAP and IFRS.

U.S. GAAP

U.S. GAAP stands for “U.S. Generally Accepted Accounting Principles” and is an accounting standard implemented in the United States. The U.S. GAAP is a standard used in the United States. alone. It is a rule-based principle and thus allows little allowances for adjustments and exceptions. It follows the core characteristics of relevance, reliability, comparability and understandability, as well as making informed decisions based on the user’s circumstances.

IFRS

The IFRS stands for “International Financial Reporting Standards” and is used by numerous countries around the world. Thus, it can be said that the IFRS is a global standard that people dealing business globally is expected to understand. Its relevance stems from the fact that it is currently in use by about 110 countries. Unlike the U.S. GAAP, it is principle-based and can be adjusted based on different interpretations. It does not take user circumstances into account but uses overall patterns to adjust.

| U.S. GAAP | IFRS | |

|---|---|---|

| Definition | A standard framework of accounting guidelines implemented in the U.S. | Standards that provide a global language for business affairs and account practices |

| Stands for | United States Generally Accepted Accounting Principles | International Financial Reporting Standards |

| Implementing body | Financial Accounting Standards Board (publishing), U.S. Securities and Exchange Commission (governing) | IFRS Foundation, International Accounting Standards Board |

| Based on | Rules | Principle |

| Implemented in | United States | 110 countries |

| Treatment of intangibles | Recognized at fair value | Recognized when there is future economic benefit with measured reliability |

| Handling of inventory costs | LIFO is allowed | LIFO is not allowed |

| Inventory write-down | Reversal is prohibited once inventory is written down | Reversible |

| Costs of development | Can be capitalized | Cannot be capitalized; expensed on the year they occur |

| Income statement presentation | Extraordinary items are segregated below net income | Extraordinary items are not segregated |

| Treatment of fixed assets | Uses the cost model | Uses the revaluation model |

| Liabilities | Split between current and noncurrent liabilities | All debts are classified as noncurrent liabilities |