Difference Between Capital Lease and Operating Lease

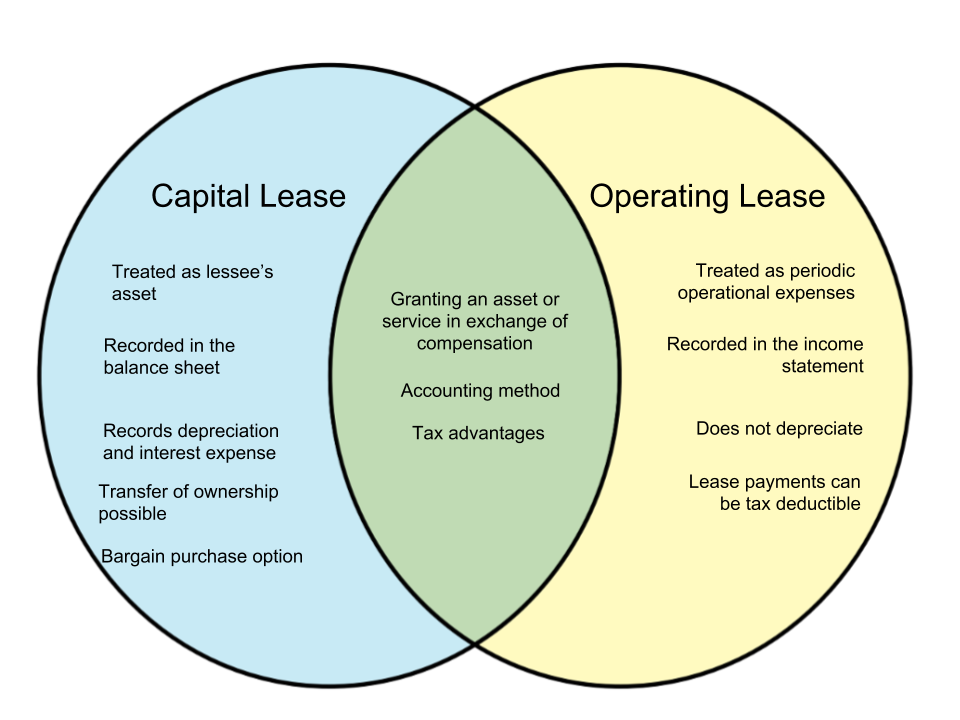

In finance, a lease is a contract wherein a person or property grants property, services, etc. for a specified period of time in exchange of payment. There are two types of accounting methods when approaching leases - capital lease and operating lease. In this article, we will discuss the distinction between the two.

Operating Lease[edit]

An operating lease is similar to renting out the asset in question and usually involve short-term periods. There is no transfer of ownership in this method of accounting. Payments are treated as periodic operating expenses and are included in the income statement. Because it is not recognized as an asset by the lessee, it is not part of the balance sheet. An operating lease is for right to use only - it does not transfer ownership from the lessor to the lessee at the end of the lease term.

Capital Lease[edit]

Meanwhile, a capital lease (also called a finance lease) is treated in a similar manner to a loan. The asset is seen as owned by the lessee and is recorded in the balance sheet. Because they are considered assets, the lessee records depreciation on the item. The asset also incurs interest expense, much like a loan. Unlike operating leases, there is an option to permanently acquire the asset after the term of the lease.

| Capital Lease | Operating Lease | |

|---|---|---|

| Definition | An accounting method for leasing wherein the lease is considered as a loan and an asset recorded under the balance sheet of the lessee | An accounting method for leasing wherein lease payments are recorded as periodic operational expenses under the income statement of the lessee |

| Treated as | An asset of the lessee | An operational expense |

| Recorded in | Balance sheet | Income statement |

| Also called | Finance lease | n/a |

| Ownership | Ownership may be transferred at the end of the term | The lessor retains ownership of the asset at the end of the term |

| Bargain purchase option | Option to acquire the asset at less than fair market value | Does not have an option |

| Lease term | Equal to or more than 75% of the estimated useful life of the asset | Less than 75% of the estimated useful life of the asset |

| Calculation of present value of lease payments | Equal to or more than 90% of the original cost of the asset | Less than 90% of the asset’s fair value |

| Taxation | Lessee can claim depreciation expense and interest expense | Lease payments are considered rental expense |

| Advantages | Depreciation and interest expenses reduce taxable income | Greater flexibility, simpler accounting, less risks, lease payments are deductible from taxes |

| More appropriate for | Entities with higher tax brackets | Entities with lower tax brackets |