Difference between Insurance Broker and Insurance Agent

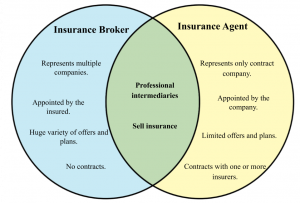

When we talk about insurances, we often hear the terms insurance agent or broker. The insurance broker is a term used to talk about a person who represents an insurance buyer, while insurance agent is the one who represents one or more insurance companies. The role of both is same in insurance, the difference between both is basically who they represent.

Insurance Broker

The insurance broker acts as an intermediary between the insurer and buyer. It represents the professional who deals with the insurer or insurance buyer. He has full disclosure on commission rates. Unbiased recommendations are provided by insurance brokers to their clients. Insurance broker has two types called as Retail Broker and Wholesale Broker. They help the insured to have best insurance plan for himself and help protect his financial interests.

Insurance agent

Insurance agent represents a professional who has contracts with one or more insurers or it can be with single company but their multiple offers. The agent sells the policies of that particular company it has contract with. Insurance Agent further have two types which are named as Independent Agent and Captive Agent. An agent helps companies to sell their insurance plans and opt for those plans which can earn more money for them.

| Header text | Insurance broker | Insurance agent |

|---|---|---|

| Representation | Broker represents multiple companies for prospective insured. | It represents only company it has contract with. |

| Appointment | Broker is appointed by the insured himself. | Agent is appointed by the company via contract. |

| Contracts | No contracts. | Contracts with one or more insurer. |

| Variety of Plans and offers | A huge variety. | Limited number of offers only the ones with a contract. |

| Salary | Each sold policy have commission paid by insurance company. | Fixed salary by the company and bonus based on sales result. |