Difference Between Partnership and Corporation in Canada

There are many types of businesses. The most basic classification would be sole proprietorship, partnership and corporation. Even then, the description of these business types vary by country. In this article, we will list the differences between a partnership and corporation in Canada.

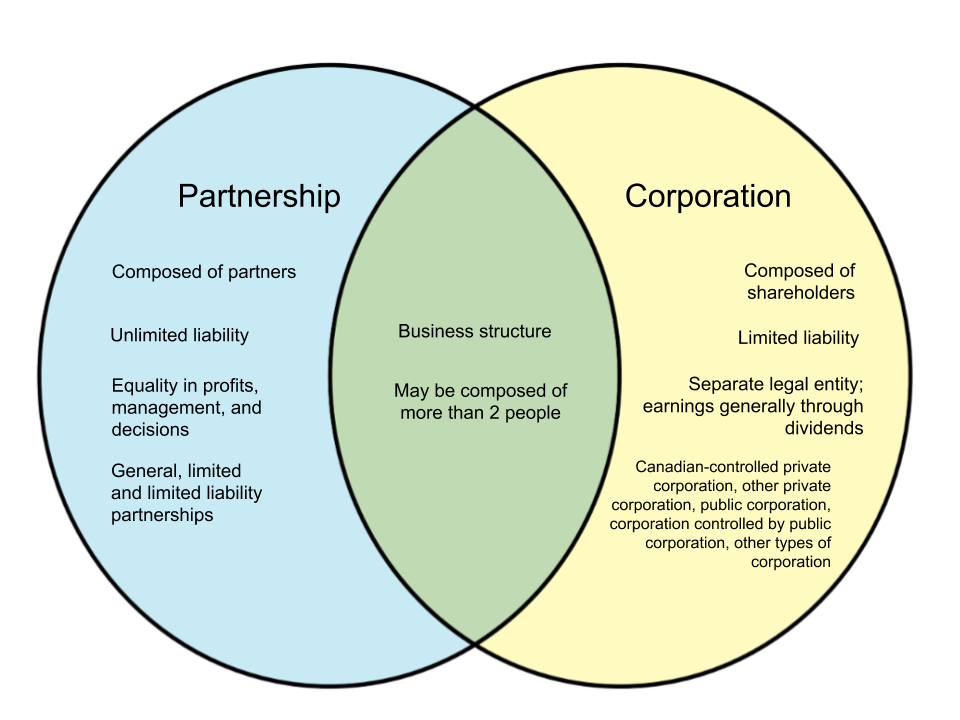

Partnership

In Canada, a partnership is defined as a non-incorporated business that is made by at least two legal entities. Similar to the basic structure of any partnership, the partners combine financial resources, property or labor into the business and afterwards share the profits based on the profit-sharing agreement. A partnership may be composed of individuals, trusts, corporations, and even other partnerships.In Canada, there are three kinds of partnership - general, limited, and limited liability partnership, although the latter is usually only available in high-risk environments.

Corporation

Meanwhile, a corporation is a business structure that is considered a legal entity separate from its shareholders. A corporation is composed of shareholders who invest in the business with the expectation of a return of dividends. A company can be incorporated at federal or provincial/territorial levels. Corporations are also known as limited companies.

| Partnership | Corporation | |

|---|---|---|

| Definition | A business structure where partners invest financial resources, property, skills or labor with the purpose of dividing resulting profit | A business structure that exists as a separate legal entity than its shareholders |

| Minimum members | 2 | 1 |

| Members | Partners | Shareholders |

| Types | General, limited, limited liability | Canadian-controlled private corporation, other private corporation, public corporation, corporation controlled by public corporation, other types of corporation |

| Advantages | Relatively easy and inexpensive, shared startup costs, equal share of assets and authority, partners can carry the tax burden if income is low or negative | Limited liability, transferable ownership, continuous existence, separate legal entity, easier capital acquisition, tax advantages |

| Disadvantages | No legal separation, unlimited liability, possible conflicts between partners, financial and legal liabilities for business decisions | Close regulation, more expensive startup costs, extensive requirement for records and documentation, potential conflicts |

| Associated laws | Partnership Act, Limited Partnership Act | Canada Business Corporations Act, Boards of Trade Act, Canada Not-for-profit Corporations Act, Canada Cooperatives Act |