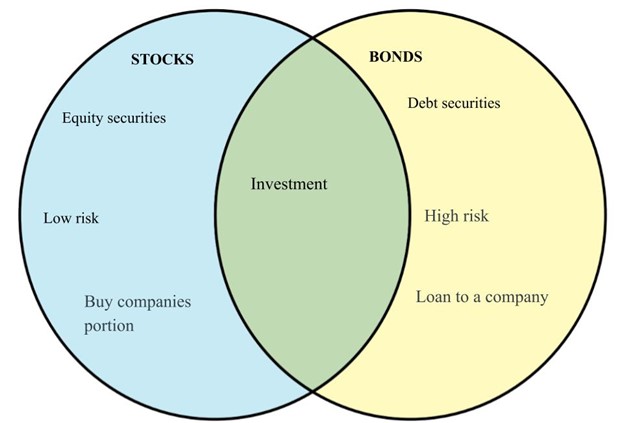

Difference between Stocks and Bonds

When it comes to investment or allocation of money, people don't only get confused with these two concepts. This could lead into making the wrong choice of investments and have repercussions in the long run. Although bonds and stocks are two of the most traded varieties of assets, you may trade them on public exchanges. Stocks grant you partial ownership right in a corporation, and a stock market is a place where investors trade equity securities like shares. Whereas bonds are just a "loan" that comes from you to a company or government, the bond market is where investors trade debt securities. The most notable difference between stocks and bonds is how they generate profit.

Stocks

Stocks depict equity or partial ownership in a corporation or company. When you purchase stock, it implies that you are purchasing a portion of the company. And the higher the shares you buy, the higher the portion of the company you own. For instance, a corporation has a $100/share stock price, and you buy $5000 (that is 50 shares for $100 each). Stocks are alternatively known as equity securities, corporate shares, corporate stock, common stock, and equity shares. Companies and corporations may issue shares to the public for various reasons. However, the major reason most times is to raise funds that can be used to boost future growth.

Bonds

Bonds are loans you give to a government or company. In this case, there is nor equity neither shares, involved. In other words, a corporation or company is owing to you or in debt to you when you buy a bond. Interest will be paid to you by this corporation or company on loan for a set period, after which it will repay the total amount you bought the bond. In some cases, you may not get back your full principal if the company goes bankrupt during the bond period. The time duration of bonds and interest rate will depend on the type of bond you buy. However, generally, bonds range from a few days to about 30 years.

| Stocks | Bonds | |

|---|---|---|

| Risk involved | Low | High |

| Investment type | Buy companies portion | Loan to a company |

| Alternatives | Equity securities | Debt Securities |