Differences between Amortization and Depreciation

Contents

Amortization vs. Depreciation

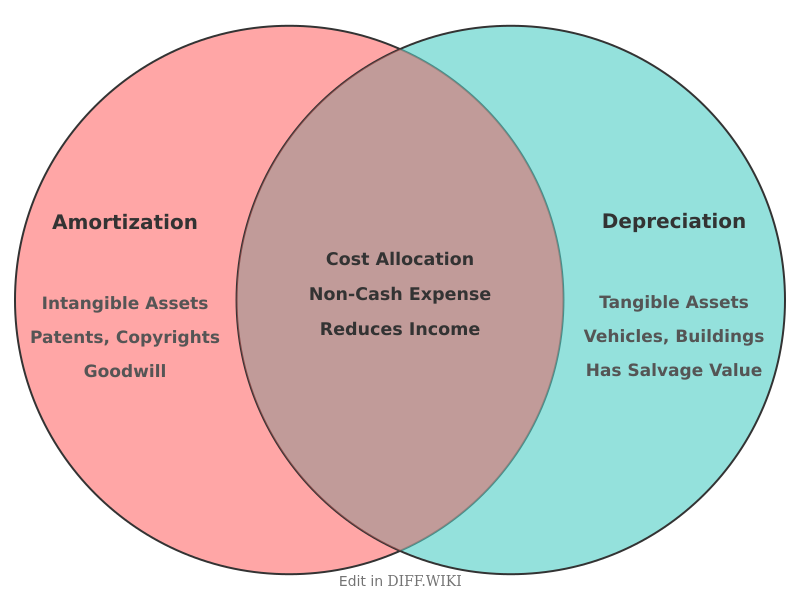

Amortization and depreciation are accounting methods used to spread the cost of a business asset over its useful life.[1] While both concepts involve expensing an asset over time, they apply to different types of assets.[2] Depreciation is used for tangible assets, which are physical items, while amortization is applied to intangible assets, which are non-physical.[3]

Both processes allow a business to match the cost of an asset to the revenue it helps to generate, which is a core accounting principle.[4] This gradual expensing of an asset avoids a large, one-time charge against income when the asset is acquired.[5] For tax purposes, both amortization and depreciation reduce a company's taxable income.[3]

The recording of these expenses is similar. On the income statement, both are listed as expenses, often on the same line item labeled "Depreciation and Amortization."[3] On the balance sheet, the carrying value of the asset is reduced by the accumulated amortization or depreciation.

Comparison Table

| Category | Amortization | Depreciation |

|---|---|---|

| Asset Type | Intangible assets (e.g., patents, copyrights, trademarks, franchise agreements).[3] | Tangible assets (e.g., buildings, machinery, vehicles, equipment).[3] |

| Nature of Asset | Non-physical assets. | Physical assets.[4] |

| Cause of Value Decline | Passage of time, contractual or legal life expiration, obsolescence. | Wear and tear, usage, obsolescence.[4] |

| Common Calculation Method | Almost always the straight-line method.[3] | Various methods, including straight-line, declining balance, and sum-of-the-years' digits.[1] |

| Salvage Value | Typically does not have a salvage value, as intangible assets are often worthless at the end of their useful life.[1][3] | Often has a salvage or residual value, which is the estimated resale value at the end of its useful life. |

| Typical Useful Life | Often determined by legal or contractual terms (e.g., the life of a patent). For U.S. tax purposes, many intangibles are amortized over 15 years. | Estimated based on the expected period of productivity for the business, which can vary widely by asset type. |

Calculation Methods

The most common method for calculating amortization is the straight-line method. This approach allocates the cost of the intangible asset evenly over each period of its useful life. The formula for the annual amortization expense is the initial cost of the asset divided by its useful life.

Depreciation can be calculated using several methods. The straight-line method is the simplest, where the asset's cost, minus its salvage value, is divided by its useful life. Accelerated depreciation methods, such as the declining balance or the sum-of-the-years'-digits methods, allow for a larger portion of the asset's cost to be expensed in the earlier years of its life.[1][3] This can provide a greater tax benefit sooner.

Financial Statement Impact

Both amortization and depreciation are considered non-cash expenses because they do not involve a direct outlay of cash in the period they are recorded.[4] They reduce the reported net income on the income statement. On the balance sheet, the accumulated amortization or depreciation is recorded in a contra-asset account, which reduces the book value of the corresponding asset over time.[3]