Differences between Call Option and Put Option

Contents

Comparison Article

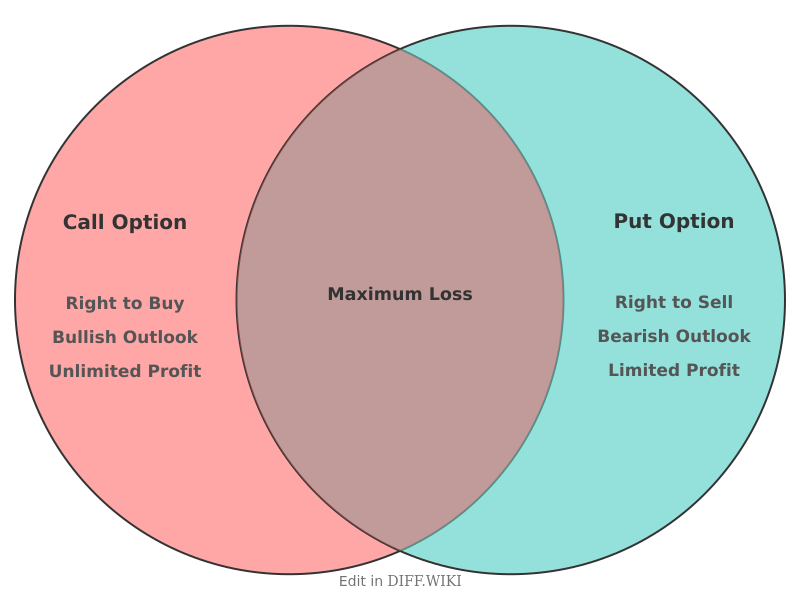

In finance, **call options** and **put options** are the two primary types of options contracts.[1][2] An option is a derivative contract that gives its buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price, known as the strike price, on or before a certain date.[3][4] A call option gives the holder the right to buy an asset, while a put option gives the holder the right to sell an asset.[2][3]

Comparison table

| Feature | Call Option | Put Option |

|---|---|---|

| Holder's Right | Right to buy an underlying asset at the strike price. | Right to sell an underlying asset at the strike price.[5] |

| Writer's Obligation | Obligation to sell the underlying asset if exercised.[5] | Obligation to buy the underlying asset if exercised.[1] |

| Buyer's Market Outlook | Bullish (expects the asset's price to rise).[2] | Bearish (expects the asset's price to fall).[1][4] |

| When Profitable for Buyer (at expiry) | When the market price is above the strike price. | When the market price is below the strike price. |

| Profit Potential (for Buyer) | Theoretically unlimited.[1] | Substantial, but limited (price cannot fall below zero). |

| Maximum Loss (for Buyer) | Limited to the premium paid for the option. | Limited to the premium paid for the option. |

Rights and obligations

The key distinction between a call and a put option lies in the action the holder is entitled to take.[2] The buyer of an option, known as the holder, has rights, whereas the seller, known as the writer, has obligations.[5]

A call option holder has the right to purchase the underlying asset at the agreed-upon strike price. If the holder chooses to exercise this right, the writer of the call option is obligated to sell the asset to the holder at that strike price, regardless of the current market price.

Conversely, a put option holder has the right to sell the underlying asset at the strike price.[1][5] If the put holder exercises their option, the writer of the put is obligated to purchase the asset from the holder at the strike price.[1] In both cases, the buyer can choose to let the option expire without exercising it, in which case the only loss is the initial premium paid for the contract.

Market sentiment

Call and put options are often used to speculate on the future direction of an asset's price. A trader who is bullish believes the price of an asset will increase and may buy call options to profit from the upward move. Buying calls allows for a potentially unlimited profit if the asset price rises, while the risk is fixed to the cost of the option premium.[1]

A trader who is bearish has the expectation that an asset's price will decrease.[1] This trader might buy put options, which increase in value as the underlying asset's price falls.[2][4] This strategy also has a predefined maximum loss equal to the premium paid. The trading volumes of puts versus calls are often monitored through the put-call ratio, which can be used as an indicator of prevailing market sentiment.

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 "corporatefinanceinstitute.com". Retrieved January 23, 2026.

- ↑ 2.0 2.1 2.2 2.3 2.4 "tastylive.com". Retrieved January 23, 2026.

- ↑ 3.0 3.1 "investopedia.com". Retrieved January 23, 2026.

- ↑ 4.0 4.1 4.2 "schwab.com". Retrieved January 23, 2026.

- ↑ 5.0 5.1 5.2 5.3 "investopedia.com". Retrieved January 23, 2026.