Differences between Capex and Opex

Differences between Capex and Opex

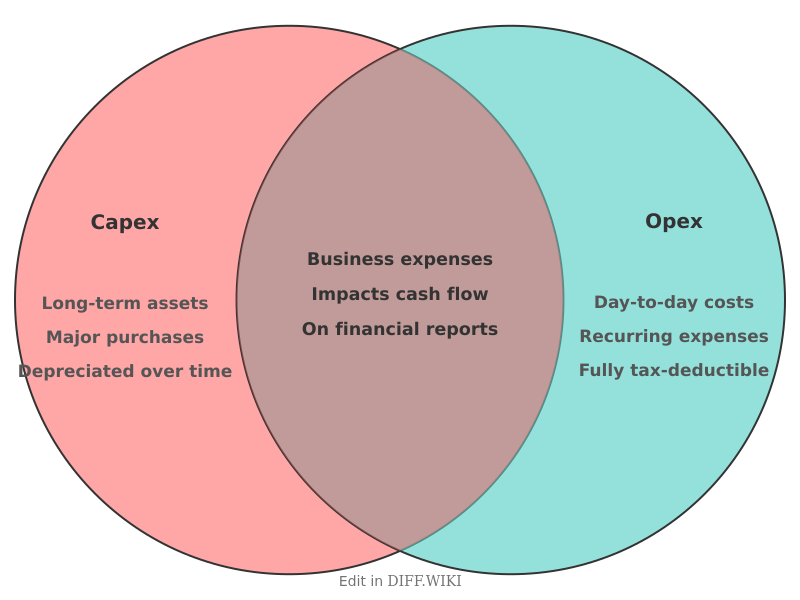

In business finance, expenses are broadly categorized as either capital expenditures (Capex) or operating expenses (Opex).[1][2] Capex refers to significant, long-term investments in physical assets, while Opex covers the day-to-day costs of running a business.[3] Understanding the distinction is important for financial planning, accounting, and tax purposes.[4]

Capital expenditures are funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, technology, or equipment.[5] These are considered investments in the future growth and capacity of the company. In contrast, operating expenses are the ongoing costs required for the daily functioning of the business, such as salaries, rent, utilities, and maintenance.

The accounting treatment for Capex and Opex is a primary point of difference. Capex is not fully expensed in the year it is incurred; instead, it is capitalized as an asset on the balance sheet and depreciated over its useful life. Opex, however, is fully deducted from revenue on the income statement in the accounting period it is incurred, directly impacting the company's reported profit. This also leads to different tax treatments, as Opex can be fully deducted in the current year, while Capex deductions are spread out over time through depreciation.

Comparison Table

| Category | Capex (Capital Expenditure) | Opex (Operating Expenditure) |

|---|---|---|

| Nature of Expense | Major, long-term investments to acquire or upgrade assets.[1] | Day-to-day, recurring costs for running the business. |

| Time Horizon | Benefits extend beyond one year.[1][4] | Benefits are typically consumed within one year.[1][4] |

| Financial Statement Impact | Recorded as an asset on the balance sheet. | Recorded as an expense on the income statement. |

| Accounting Treatment | Capitalized and depreciated over the asset's useful life. | Expensed in the period it is incurred. |

| Tax Implications | Deducted over several years through depreciation. | Fully deductible in the year incurred. |

| Examples | Buildings, machinery, vehicles, patents, and equipment purchases.[1] | Salaries, rent, utilities, maintenance, and office supplies.[1] |

The decision to classify an expense as Capex or Opex can be strategic. For instance, leasing equipment would be an operating expense, while purchasing it outright is a capital expenditure.[1] Some businesses may prefer Opex for its immediate tax benefits and financial flexibility, as it doesn't tie up large amounts of capital. However, choosing Capex can increase the company's asset base on the balance sheet, which can be beneficial for securing financing. Ultimately, the management of both Capex and Opex is essential for a company's short-term operational efficiency and long-term strategic growth.[1]

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 "investopedia.com". Retrieved December 29, 2025.

- ↑ "deiser.com". Retrieved December 29, 2025.

- ↑ "financealliance.io". Retrieved December 29, 2025.

- ↑ 4.0 4.1 4.2 "xero.com". Retrieved December 29, 2025.

- ↑ "investopedia.com". Retrieved December 29, 2025.