Differences between FIFO and LIFO

Contents

FIFO vs. LIFO

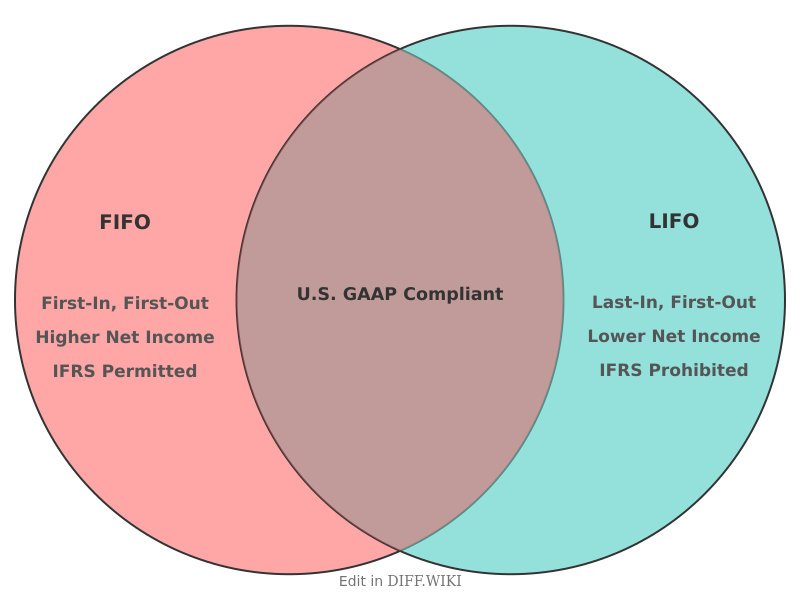

First-In, First-Out (FIFO) and Last-In, First-Out (LIFO) are two common methods used for inventory valuation.[1] The choice between these methods can significantly impact a company's financial statements and tax liabilities.[2] FIFO is based on the principle that the first goods purchased are the first ones sold.[3] Conversely, LIFO operates on the assumption that the most recently acquired items are sold first.[4][5]

The selection of an inventory valuation method affects the calculation of the cost of goods sold (COGS) and, consequently, the reported net income. During periods of rising prices, FIFO results in a lower COGS because it uses the cost of older, less expensive inventory first. This leads to a higher reported net income and a greater tax liability. In the same inflationary environment, LIFO produces a higher COGS by expensing the cost of the newest, more expensive items first, which in turn leads to lower reported profits and a reduced tax burden.

The impact on the balance sheet also differs between the two methods. With FIFO, the ending inventory is valued at the most recent costs, which more closely reflects the current market value. In contrast, LIFO can result in an understatement of inventory value on the balance sheet because the remaining inventory consists of older, lower-cost items.

Accounting standards for the use of these methods vary internationally. U.S. Generally Accepted Accounting Principles (GAAP) permit the use of both FIFO and LIFO.[2] However, International Financial Reporting Standards (IFRS) prohibit the use of LIFO, making FIFO the more widely accepted method globally.[2]

Comparison Table

| Category | FIFO (First-In, First-Out) | LIFO (Last-In, First-Out) |

|---|---|---|

| Cost Flow Assumption | Assumes the first units purchased are the first ones sold. | Assumes the last units purchased are the first ones sold.[4] |

| Impact on COGS (Rising Prices) | Lower cost of goods sold. | Higher cost of goods sold. |

| Impact on Net Income (Rising Prices) | Higher net income. | Lower net income. |

| Tax Implications (Rising Prices) | Higher tax liability. | Lower tax liability. |

| Ending Inventory Valuation | Reflects current costs more accurately. | May be significantly undervalued. |

| Compliance with IFRS | Permitted.[2] | Prohibited.[2] |

| Compliance with U.S. GAAP | Permitted.[2] | Permitted.[2] |

Physical Flow of Inventory

The FIFO method often aligns with the natural physical flow of products, especially for businesses dealing with perishable goods or items that can become obsolete.[1] For example, a grocery store would sell its oldest stock first to minimize spoilage.[1] While a company might manage its physical stock on a FIFO basis, it could still choose to use LIFO for accounting purposes.[1] LIFO, however, generally does not reflect the typical physical flow of inventory, as businesses usually sell their older stock first.

LIFO Conformity Rule

In the United States, companies that opt to use the LIFO method for tax purposes are also required to use it for their financial reporting. This is known as the LIFO conformity rule. This rule discourages the use of LIFO for tax benefits while presenting a more favorable profit scenario using FIFO to shareholders.

References

- ↑ 1.0 1.1 1.2 1.3 "wikipedia.org". Retrieved January 31, 2026.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 "corporatefinanceinstitute.com". Retrieved January 31, 2026.

- ↑ "corporatefinanceinstitute.com". Retrieved January 31, 2026.

- ↑ 4.0 4.1 "indeed.com". Retrieved January 31, 2026.

- ↑ "investopedia.com". Retrieved January 31, 2026.