Differences between FSA and HSA

Contents

FSA vs. HSA

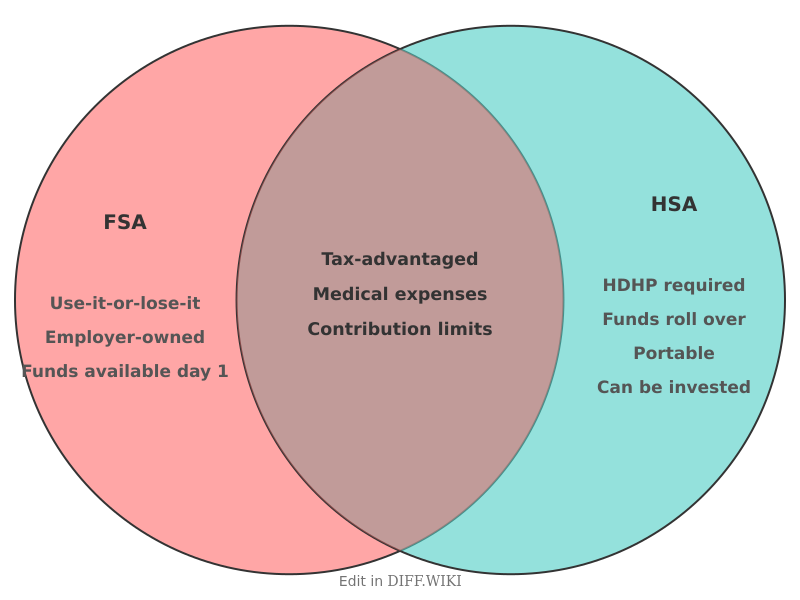

A Flexible Spending Account (FSA) and a Health Savings Account (HSA) are both tax-advantaged accounts used for out-of-pocket healthcare expenses.[1][2] An HSA is a portable savings account that belongs to the individual, allowing funds to roll over annually and be invested.[3][4] An FSA is an employer-owned account, and funds typically must be used within the plan year.[4][3] Both accounts allow users to pay for a wide range of qualified medical expenses with pre-tax money.[5]

To contribute to an HSA, an individual must be enrolled in a high-deductible health plan (HDHP), not be enrolled in Medicare, and cannot be claimed as a dependent on someone else's tax return. FSAs do not require enrollment in an HDHP and are available to any employee whose employer offers one.[3]

For 2026, the HSA contribution limit is $4,400 for self-only coverage and $8,750 for family coverage. Individuals aged 55 and older can contribute an additional $1,000. The FSA contribution limit for 2026 is $3,400 per person.

Comparison Table

| Category | Flexible Spending Account (FSA) | Health Savings Account (HSA) |

|---|---|---|

| Eligibility | Offered by an employer; no specific health plan required.[3] | Must be enrolled in a high-deductible health plan (HDHP). |

| Ownership | The employer owns the account.[4][2] | The individual owns the account.[3][2] |

| Contribution Limits (2026) | $3,400 per individual. | $4,400 for self-only coverage; $8,750 for family coverage. |

| Rollover of Funds | Employers may allow a rollover of up to $680 (for 2026) or offer a grace period; otherwise, funds are forfeited. | Funds roll over year after year without limit.[1] |

| Portability | Funds are generally forfeited upon leaving the job.[3] | The account is portable and remains with the individual regardless of employment. |

| Investment Options | Funds cannot be invested.[4] | Funds can be invested in stocks, bonds, and mutual funds.[1][3] |

| Access to Funds | The full annual contribution amount is available at the beginning of the plan year. | Funds are available as they are contributed to the account. |

| Catch-Up Contributions | Not permitted. | Individuals aged 55 and older can contribute an additional $1,000 annually. |

Qualified Expenses

Both FSA and HSA funds can be used for a variety of IRS-qualified medical expenses. These typically include costs for doctor visits, hospital stays, prescription medications, dental and vision care, and medical equipment. Over-the-counter medicines and menstrual care products are also eligible expenses.

In some cases, a letter of medical necessity from a healthcare provider may be required for certain expenses, such as weight-loss programs or specific dietary supplements. Generally, expenses for overall health, like gym memberships or vitamins for general well-being, are not considered qualified medical expenses.

Rollover and Forfeiture Rules

A key difference between the two accounts lies in the handling of unused funds at the end of the year. HSA balances automatically roll over to the next year, allowing the account holder to accumulate savings over time for future medical needs.

FSAs, on the other hand, have a "use-it-or-lose-it" rule. However, employers have the option to offer either a grace period of up to 2.5 months to spend the remaining funds or to permit a rollover of a limited amount to the next plan year. For 2026, the maximum rollover amount is $680. If an employer offers neither of these options, any unused funds are forfeited at the end of the plan year. An employer cannot offer both a grace period and a rollover option.

References

- ↑ 1.0 1.1 1.2 "metlife.com". Retrieved January 16, 2026.

- ↑ 2.0 2.1 2.2 "aetna.com". Retrieved January 16, 2026.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 "fidelity.com". Retrieved January 16, 2026.

- ↑ 4.0 4.1 4.2 4.3 "metlife.com". Retrieved January 16, 2026.

- ↑ "azblue.com". Retrieved January 16, 2026.