Differences between Loan and Mortgage

Loan vs. Mortgage

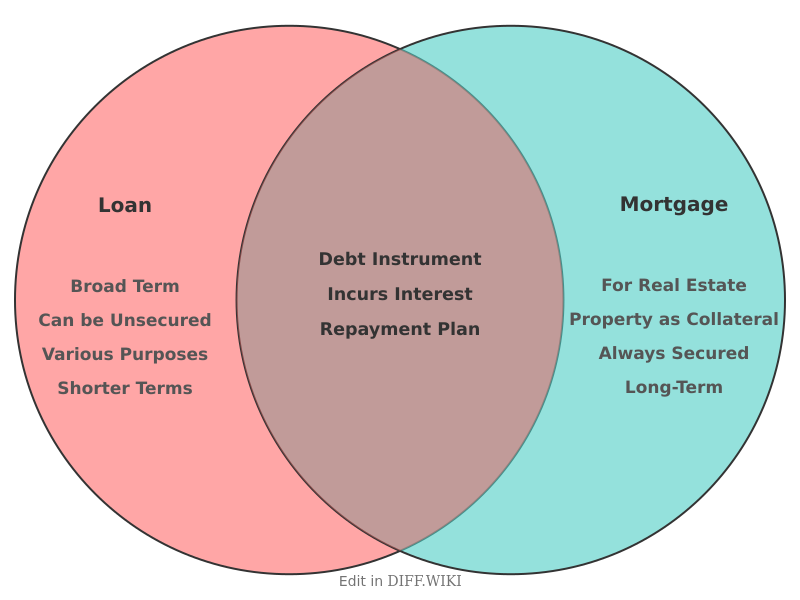

While the terms are often used interchangeably, a mortgage is a specific type of loan used to purchase real estate.[1][2] A loan is a broader financial term for a sum of money borrowed from a lender that must be repaid over time, typically with interest.[3][4] Therefore, all mortgages are loans, but not all loans are mortgages.[2] The primary distinctions between the two lie in their purpose, the requirement of collateral, repayment terms, and interest rates.[5]

A mortgage is an agreement where a lender provides funds to a borrower specifically for the purchase of property, such as a house or land. The property itself serves as collateral, meaning the lender has a legal claim to it and can foreclose or repossess it if the borrower fails to make payments. Loans, on the other hand, can be used for various purposes, such as consolidating debt, financing a vehicle purchase, or covering educational expenses. Some loans, known as secured loans, require collateral like a car or savings account, while unsecured loans do not.

The repayment period for mortgages is typically much longer than for other loans, often extending 15 to 30 years.[1] This extended timeframe results in lower monthly payments compared to a shorter-term loan for the same amount. General loans usually have shorter repayment periods, ranging from a few years for a car loan to several years for a personal loan.

Interest rates for mortgages are generally lower than those for unsecured personal loans.[1] This is because the property acts as security for the lender, reducing their financial risk.[1] Unsecured loans present a higher risk to lenders, which is reflected in higher interest rates.

Comparison Table

| Category | Loan | Mortgage |

|---|---|---|

| Purpose | Can be used for various reasons, such as debt consolidation, vehicle purchase, or education funding. | Specifically used to finance the purchase of real estate, like a home or land. |

| Collateral | May be secured with collateral (e.g., a car) or unsecured (no collateral required). | Always secured by the property being purchased. |

| Repayment Term | Typically shorter, ranging from a few to several years. | Typically longer, often 15 to 30 years.[1] |

| Interest Rates | Generally higher, especially for unsecured loans, due to greater lender risk.[1][2] | Generally lower because the property serves as security, reducing lender risk.[1] |

| Loan Amount | Tends to be for smaller amounts compared to mortgages. | Typically involves large sums of money needed for real estate purchases. |

| Closing Costs | Usually do not involve closing costs. | Almost always includes closing costs, which can be 3%–6% of the loan amount. |

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 "mortgage.shop". Retrieved December 08, 2025.

- ↑ 2.0 2.1 2.2 "turkinmortgage.com". Retrieved December 08, 2025.

- ↑ "corporatefinanceinstitute.com". Retrieved December 08, 2025.

- ↑ "investopedia.com". Retrieved December 08, 2025.

- ↑ "assurancemortgage.com". Retrieved December 08, 2025.