Differences between Ordinary Dividends and Qualified Dividends

Ordinary Dividends vs. Qualified Dividends

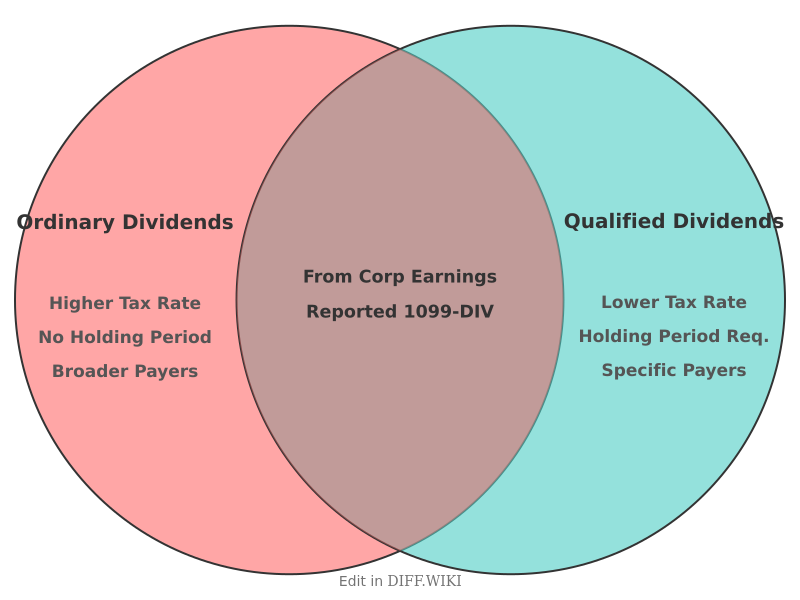

In United States tax law, dividends paid to shareholders are classified as either ordinary or qualified, a distinction that primarily affects the tax rate applied to the income.[1][2] An ordinary dividend is a distribution of a portion of a company's earnings to its shareholders.[3][4] A qualified dividend is an ordinary dividend that meets specific criteria set by the Internal Revenue Service (IRS), allowing it to be taxed at lower, long-term capital gains rates.[5][2]

The concept of qualified dividends was introduced in the Jobs and Growth Tax Relief Reconciliation Act of 2003.[2] Prior to this act, all dividends were taxed at the shareholder's ordinary income tax rate. The change was intended to encourage companies to pay dividends and to incentivize investors to hold stocks for longer periods. For a dividend to be classified as qualified, it must be paid by a U.S. corporation or a qualified foreign corporation, and the investor must meet a minimum holding period for the stock.[4]

All dividends are considered ordinary dividends by default.[3] Those that do not meet the criteria for qualified status are taxed at the recipient's regular income tax rate.[1] This includes dividends from certain entities such as real estate investment trusts (REITs) and money market funds. The paying institution is responsible for indicating on the Form 19-DIV whether the dividends paid are qualified.[3]

Comparison Table

| Category | Ordinary Dividend | Qualified Dividend |

|---|---|---|

| Tax Rate | Taxed at the individual's ordinary income tax rates. | Taxed at lower long-term capital gains tax rates, which can be 0%, 15%, or 20% depending on taxable income.[4] |

| Source | Paid from the earnings and profits of a corporation.[3][4] | Must be paid by a U.S. corporation or a qualified foreign entity that trades in the U.S. or has a tax treaty.[4] |

| Holding Period | No minimum holding period required. | The stock must be held for more than 60 days during the 121-day period that begins 60 days before the ex-dividend date. For preferred stock, the holding period is more than 90 days during a 181-day period.[4] |

| Examples of Non-Qualifying Payers | Dividends from money market funds, real estate investment trusts (REITs), and master limited partnerships (MLPs). | N/A |

| Reporting | Reported on Form 1099-DIV.[3] | Specifically identified as qualified dividends on Form 1099-DIV.[3] |

References

- ↑ 1.0 1.1 "bankrate.com". Retrieved January 27, 2026.

- ↑ 2.0 2.1 2.2 "wikipedia.org". Retrieved January 27, 2026.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 "kahnlitwin.com". Retrieved January 27, 2026.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 "investopedia.com". Retrieved January 27, 2026.

- ↑ "kiplinger.com". Retrieved January 27, 2026.