Differences between Tax Credit and Tax Deduction

Contents

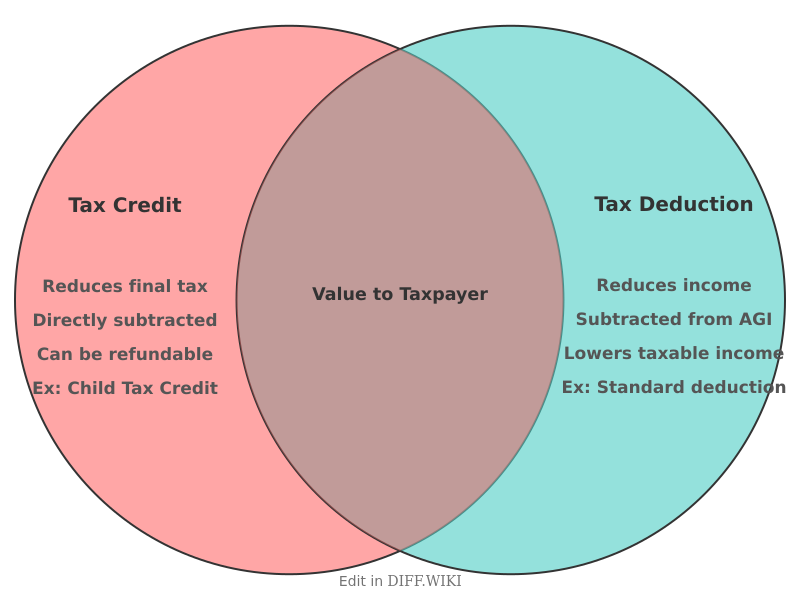

Tax Credit vs. Tax Deduction

Both tax credits and tax deductions can reduce a taxpayer's liability, but they function in different ways.[1] A tax credit directly reduces the amount of tax owed, offering a dollar-for-dollar reduction of the tax bill.[2][3] In contrast, a tax deduction lowers a taxpayer's taxable income, and the value of the deduction is dependent on the individual's marginal tax bracket.[1][2] Generally, a tax credit is considered more valuable than a tax deduction of the same amount because it reduces the tax owed directly, rather than reducing the income subject to tax.[2][4]

Comparison Table

| Category | Tax Credit | Tax Deduction |

|---|---|---|

| Effect on Taxes | Reduces the final tax bill on a dollar-for-dollar basis.[5] | Reduces the amount of income that is subject to tax. |

| Calculation | Subtracted directly from the taxes owed.[3] | Subtracted from adjusted gross income (AGI) to determine taxable income.[3] |

| Value to Taxpayer | The value is the same for all taxpayers who can claim the full amount, regardless of their tax bracket. | The value depends on the taxpayer's marginal tax rate; it is worth more to those in higher tax brackets.[1] |

| Impact on Refund | Can be refundable, nonrefundable, or partially refundable. A refundable credit can result in a refund even if the tax liability is zero. | Lowers taxable income, which can lead to a lower tax liability and potentially a larger refund, but does not directly result in a refund on its own. |

| Common Examples | Child Tax Credit, Earned Income Tax Credit (EITC), American Opportunity Tax Credit.[2] | Standard deduction, itemized deductions such as mortgage interest, charitable contributions, and student loan interest. |

Types of Tax Credits

Tax credits can be categorized as refundable, nonrefundable, or partially refundable.

- Refundable credits can result in a tax refund if the credit amount is greater than the amount of tax owed. For example, if a taxpayer owes $500 in taxes but qualifies for a $1,000 refundable credit, they would receive a $500 refund. The Earned Income Tax Credit is a common example of a fully refundable credit.

- Nonrefundable credits can reduce a taxpayer's liability to zero, but no portion of the credit is paid out as a refund if it exceeds the tax owed.[2] The child and dependent care credit is an example of a nonrefundable credit.

- Partially refundable credits have a portion that can be received as a refund after the tax liability has been reduced to zero, while the other part is nonrefundable. The Child Tax Credit has a refundable component.

Types of Tax Deductions

Taxpayers can generally choose between taking a standard deduction or itemizing their deductions.

- Standard deduction is a fixed dollar amount that taxpayers can subtract from their income. The amount varies based on filing status, age, and whether the taxpayer or their spouse is blind. Most taxpayers utilize the standard deduction.

- Itemized deductions are specific expenses that can be deducted from adjusted gross income. It is generally beneficial to itemize if the total of these deductions is greater than the standard deduction amount. Common itemized deductions include mortgage interest, state and local taxes (SALT), charitable contributions, and medical and dental expenses that exceed a certain percentage of adjusted gross income.

There are also "above-the-line" deductions, which are adjustments to gross income. These can be taken regardless of whether a taxpayer itemizes or takes the standard deduction. Examples include contributions to a traditional Individual Retirement Account (IRA) and student loan interest.

References

- ↑ 1.0 1.1 1.2 "smartasset.com". Retrieved January 28, 2026.

- ↑ 2.0 2.1 2.2 2.3 2.4 "smartasset.com". Retrieved January 28, 2026.

- ↑ 3.0 3.1 3.2 "hrblock.com". Retrieved January 28, 2026.

- ↑ "usafacts.org". Retrieved January 28, 2026.

- ↑ "skfinancial.com". Retrieved January 28, 2026.