Difference Between Limit Order and Stop Order

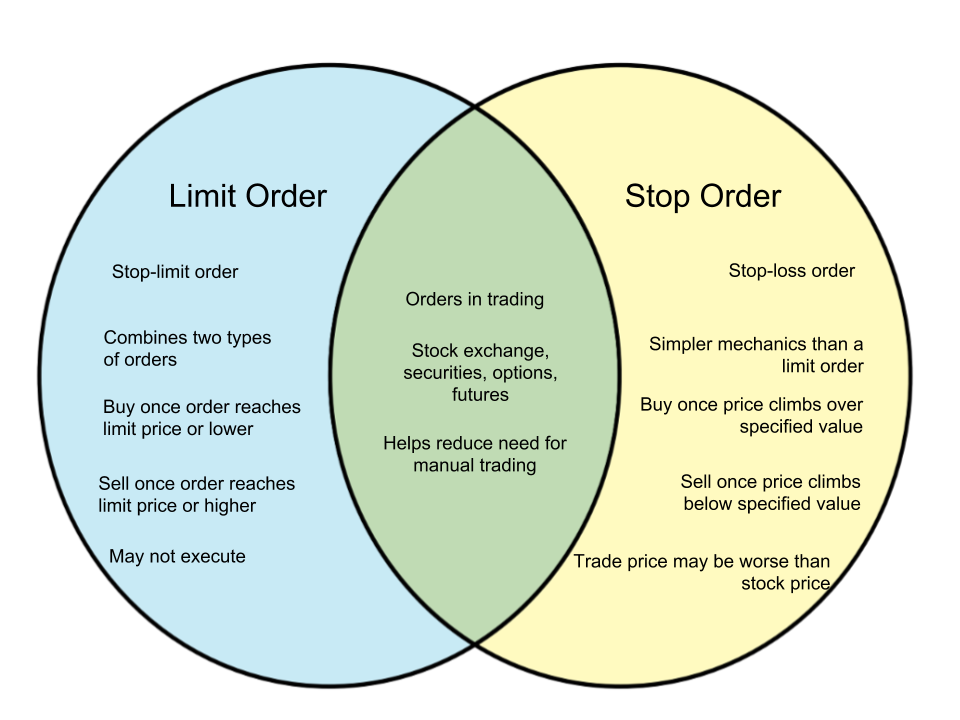

There are different terms and actions taken in the investment world and this includes the limit order and stop order. These two terms may seem similar at a glance but they can have a significant distinction in trading. In this article, we will examine the differences between a limit order and stop order.

Limit Order

A limit order is also called a stop limit order. It is a type of trading action that combines two kinds of orders. In this initiative, an order is made to buy or sell a stock at a designated price or at better value to the investor. First, investors assign a stop price. Then they assign a limit order value. If the action is buying, the buy limit order is set to be executed at the limit price set or at a lower value. On the other hand, a sell limit order will be executed once it arrives at the limit price or higher. Limit orders do not guarantee execution.

Stop Order

A stop order is a more simple action that involves setting a stop price to limit a loss or to protect profits on certain stocks under their ownership. It is also called a stop-loss order. When a stop price is reached, a market order is immediately executed. A buy stop is set above the current market price while a sell stop is below the current market price.

| Limit order | Stop order | |

|---|---|---|

| Action taken | To execute a trade at a value equal to or better than a designated price

Buy - execute order once the value reaches the limit price or a lower value Sell - execute order once the value reaches the limit price or a higher value |

To execute a trade when a value moves beyond the designated target

Buy - execute order once price climbs over set stop value; stop price designated above the current market price Sell - execute order once price climbs below set stop ; value; stop price designated below current market price |

| Purpose | To lock in prices so that investors can buy or sell at a particular price that is better for them | To limit losses or protect profits on owned stocks |

| Risks | Risk of non-execution; higher stockbroker commissions | Short term fluctuations wherein trade price is worse than the stop price |

| Also called | Stop-limit order | Stop-loss order |