Difference Between Partnership and Corporation in the Philippines

Composed of over 7000 islands, the Philippines has been a destination for tourists looking for an affordable vacation spot. This and the amount of people retiring in the country has made the Philippines a good place to start up a business. In this article, we will feature the differences of a partnership and corporation in the Philippines.

Partnership[edit]

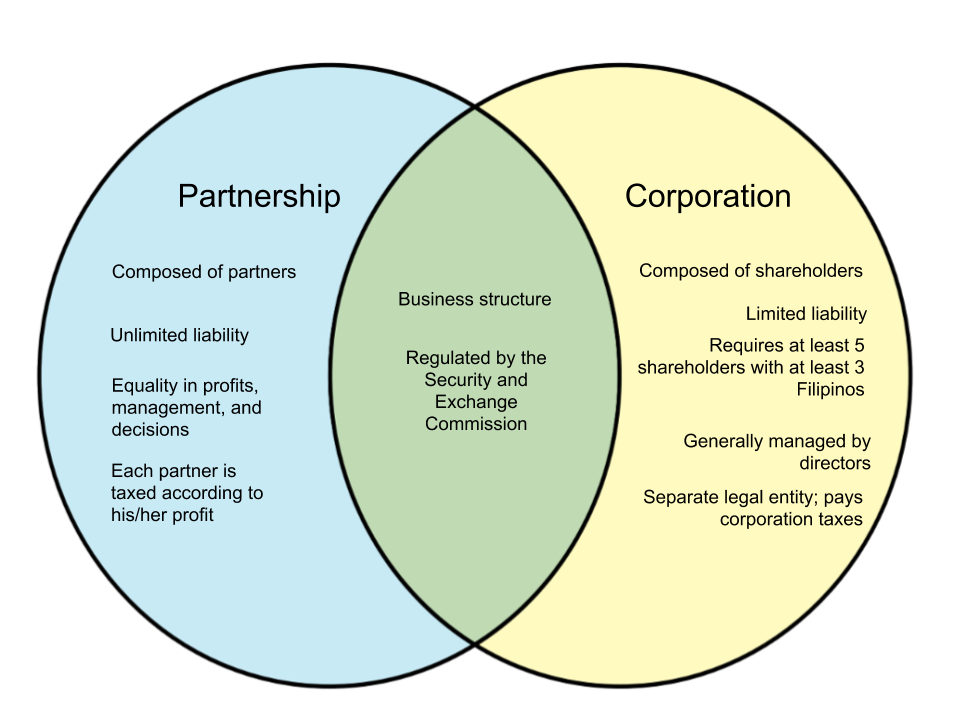

A partnership is a business structure wherein two or more legal entities contribute assets, skills and labor for the purpose of dividing profit. A partnership is distinct because of two things - joint ownership and unlimited liability. Partners generally own assets jointly, but they are also jointly liable for any debt. Any loss, liability or legal constraints that the partnership faces is answerable by all of the partners. Additionally, should the business fail or incur debt and is unable to pay for it, partners are obligated to pay through their personal assets.

Corporation[edit]

A corporation is a company owned by its shareholders, However, it is a considered a separate legal entity and is seen as a different person in the eyes of law. Risks are proportional to the amount one invests in the company. Shareholders earn in the form of dividends, while officers and employees receive a salary. In the Philippines, the Securities and Exchange Commission requires at least 5 shareholders, 3 of which are Filipino.

| Partnership | Corporation | |

|---|---|---|

| Definition | A business where partners contribute resources, skills and labor for the end purpose of dividing profit | A business structure owned by shareholders and functions as a separate legal entity |

| Composed of | Partners, employees | Shareholders, directors, officers, employees |

| Owners | Partners | Shareholders |

| Minimum amount of members | 2 members | 5 members, with at least 3 being Filipino |

| Distribution of earnings | Profit-sharing method for partners and wages for employees; partners especially industrial ones may prefer to receive a salary | Dividends for shareholders and wages for employees |

| Advantages | Shared startup costs, easier startup, shared profits and management | Larger capital, limited liability by shareholders, ability to sell shares, perpetual lifetime |

| Disadvantages | Possibility of conflict, unlimited liability, partners can be liable for debt and losses up to their personal assets, joint liability | Double taxation, independent management, complex accounts, heavy paperwork, transfer of ownership can affect management decisions |

| Taxation | Partners are taxed according to their relative profit | Corporation tax; directors are also taxed based on income they receive |

| Regulating body | Securities and Exchange Commission (SEC) | Securities and Exchange Commission (SEC) |

| Associated laws | Articles of Partnership, Foreign Investments Act, Labor Code | Corporation Code of the Philippines, Foreign Investments Act, Labor Code |