Difference between revisions of "Difference Between Savings Account and Checking Account"

(Created page with "thumb|it is important to know the difference between these two banking services When applying for an account in the bank,...") |

|

| (8 intermediate revisions by the same user not shown) | |

(No difference)

| |

Latest revision as of 17:44, 9 November 2022

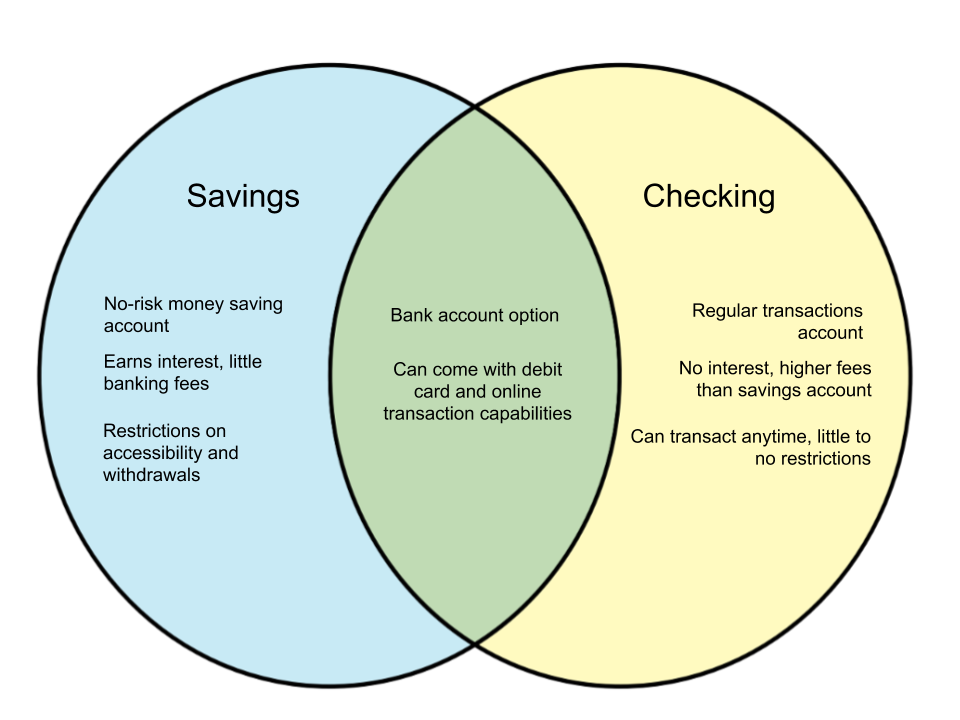

When applying for an account in the bank, you are given several options. Each bank has a different set of offerings to give, but the constant selections are the savings and checking accounts. Here, we will discuss the differences between a savings account and a checking account.

Savings Account[edit]

A savings account is more of an investment account rather than one for everyday transactions. It is designed to save your money and help you earn interest. Thus, savings accounts typically have more restrictions when it comes to withdrawing cash. Savings accounts typically don’t have check-writing privileges or an attached debit card, but these can vary per bank. Savings accounts generally charge little to no fees.

Checking Account[edit]

A checking account is a transaction account that allows account holders to frequently withdraw money with fewer restrictions. These accounts generally allow making payments/transactions with checkbooks, mobile applications, and debit cards. Because there is faster turnover for money in checking accounts, they typically have higher fees than savings accounts. Most checking accounts do not pay interest to account holders.

| Savings Account | Checking Account | |

|---|---|---|

| Definition | An account made to save money; typically earns more interest than a checking account | An account tailored for everyday transactions |

| Withdrawals | Limits number of withdrawals a month and a maximum amount per day | Generally no restrictions |

| Interest | With interest | None |

| Fees Incurred | Varies by the bank, generally lower than checking accounts | Varies by the bank, generally higher than savings accounts |

| Application | Risk-free money saving | Regular transactions |

| Minimum balance | Depends on the bank | Depends on the bank |

| Accessibility | In most cases, holder must transfer money to checking account in order to use it | Anytime |

| Transaction methods | Online transactions, bank withdrawal, sometimes debit card | Debit card, online transactions, checks, overdrafts |