Difference between Insurance and Warranty

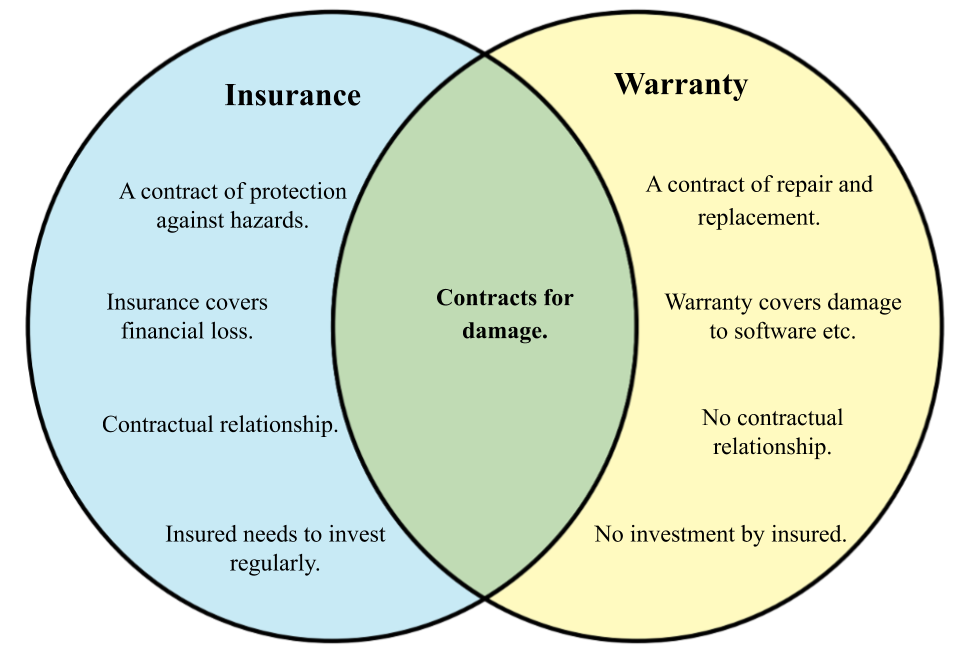

Insurance and warranty are both a type of contacts between two parties. In insurance there is a direct contractual relationship between the insurer and insured while this is not in the case of warranty.

Insurance

Insurance is a contract between insurer and insured that is protects the insured from financial loss. It policy is the legal contract between insurer and insured that includes conditions that apply for the company to pay out insurance amount. It is a protection from financial losses. A small investment can result in big amount of insurance provided by company upon agreement. There are various types of insurance including life insurance, auto insurance, education insurance, home insurance etc.

Warranty

A warranty is a mere promise or a contract that is aimed to compensate for the cost of product damage under a certain time limit. Warranty is provided by the manufacturer to their consumers without having a direct contractual relationship. A service provider or product manufacturer provides documentary guarantee of the product or service. Relating it to insurance, as in health insurance the insured needs to provide warranty that he/she would not suffer from certain disease. But if it happens the insurer can cancel policy.

| Insurance | Warranty | |

|---|---|---|

| Type | A contract that govern protection against hazards. | A contract that governs repair or replacement of an item after damage. |

| Purpose | Insurance aims to cover financial loss, damage or theft. | Warranty aims to cover the damage caused to the software or hardware of any device or product. |

| Contractual relationship | Yes. | No. |

| Cancellation | Can be cancelled by both parties anytime. | Can be cancelled both parties but only during specified period. |

| Cost | Insured regularly needs to invest. | There is no investment by the consumer. |

| Damage Cost | It covers the damage cost that is beyond repair. | Warranty covers the damage cost for repair. |