Difference between Pension and Retirement

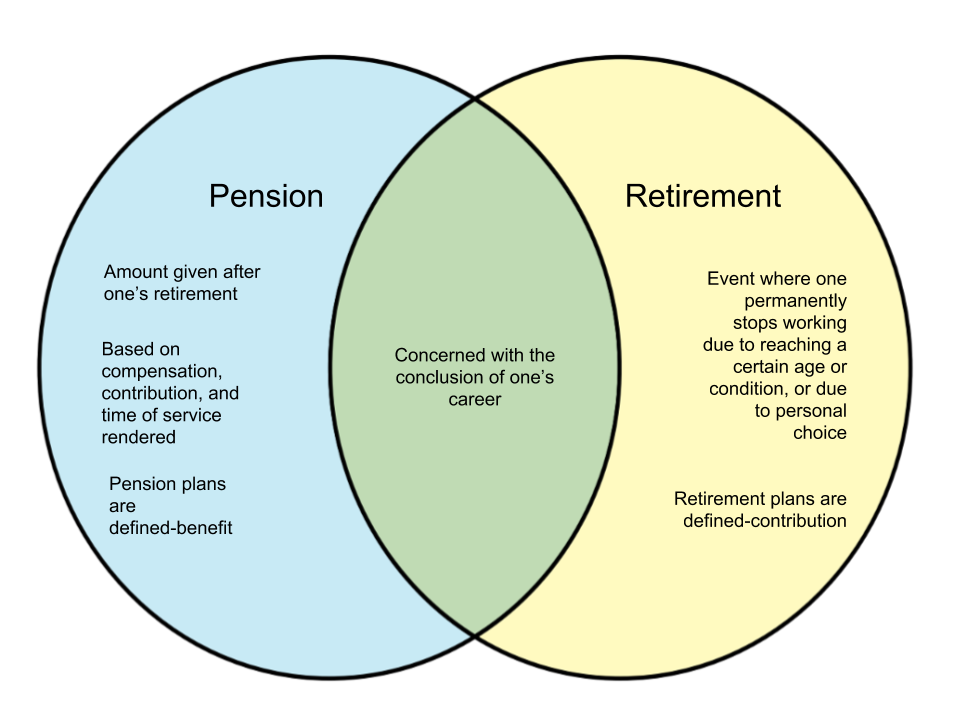

Pension and retirement are both something that people look forward too. Despite their wide usage in language, however, the two terms are oftentime confused. Here, we will differentiate the terms pension and retirement.

Pension is used to refer to a defined amount of money that is handed to an individual on the event of their retirement. This pension is something that one earns for working for a particular amount of time. Different factors like the amount of time spent on the job, performance variables, and rate contribute to determining how much pension one receives.

On the other hand, retirement is defined as the period when one decides to stop working for good. Depending on the country or state, one usually reaches retirement age at 60 or 65 years, but may choose to continue working as a consultant or some form of job to continue receiving income. One may also opt for early retirement.

In short, retirement is the state of cessation of working while pension is the amount given to the individual after retirement.

Pension and Retirement Plans

Another pair of terms that are thought to be synonymous with each other are pension and retirement plans.

A retirement plan is a scheme made by a retiree or a prospective retiree to secure their future funds after retirement. An example of a retirement plan would be the 401(k) plan or defined contribution plan, where the employee and employer contribute a particular amount to the retirement account. Retirement plans can also branch out to investments and hedge funds.

A pension plan is a type of retirement plan. It is usually in the form of a defined-benefit plan. In this scheme, employers set aside an amount into an investment pool that will eventually be used to pay pension benefits to retired employees.

| Pension | Retirement | |

|---|---|---|

| Definition | An amount of money received after retirement based on certain variables, from employers and/or social security. | The state of retiring or stopping work; usually when one comes to retirement age or personally decides to seek to retire |

| Subject | Pensioner | Retiree |

| Key Points | An amount received for work rendered after retirement; based on points such as time rendered on work and compensation; can also be received as social pension from social security | An event that occurs when one reaches retirement age or decides to stop working indefinitely; employees may decide to extend career life as consultants, substitute teachers, etc. |

| As financial plans | Generally handled by employers by putting aside an amount which will be invested and given to retirees as pension benefits; this scheme is becoming more obsolete over time | Can come in many forms such as 401(k)s, investments, and hedge funds |

| Forms in financial planning | Defined-benefit plan | Defined-contribution plan |