Difference between Robinhood and Acorns

Robinhood

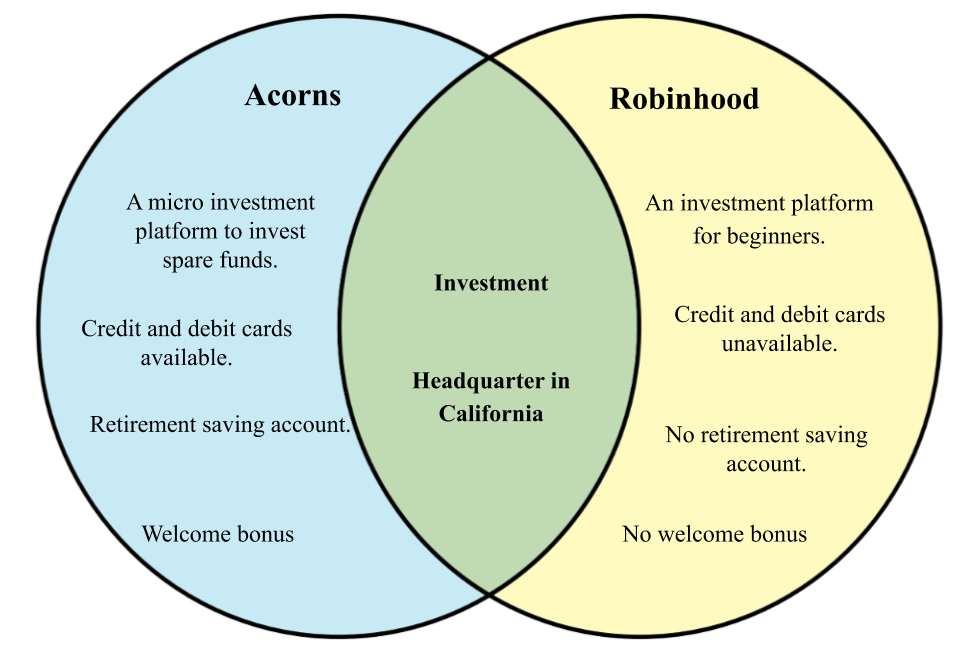

Robinhood is an investment platform that can be operable on mobile devices including both Android and iOS. It is an ideal trading platform for beginners, and the only exchange platform that allows cryptocurrency exchange. There is no minimal fee requirement for the traders on Robinhood. Robinhood Gold is one of the services that provides opportunity to the traders to trade on a margin. It is their revenue generation point as well.

Acorns

Acorns is an American company for financial services and technology. The specialization of Acorns is micro investment and robo-investment. The company Acorns has its services divided into three categories. In the first category, members can invest spare change in ETFs. The second category enables the investors to create and fund their own IRAs. Finally, the last category provides debit cards to their customers through Visa. There are different subscriptions ranging from $1, $2 and $3 per month depending upon the package type.

Acorns has its free services for students to invest their spare change.

| Robinhood | Acorns | |

|---|---|---|

| Type | An investment company for beginners. | A micro investment company to invest spare funds as saving. |

| Launched | It was launched in 2013. | Acorns was launched in 2012. |

| Headquarters | Headquarter are located in California. | Headquarters of Acorns are also located in California. |

| Other banking services | No credit or debit card. | Credit and debit cards are available. |

| Retirement saving account | No retirement saving account. | A retirement saving account is provided. |

| Welcome bonus | No welcome bonus. | A 15% welcome bonus is provided for up to $500. |