Difference between Vanguard and Fidelity

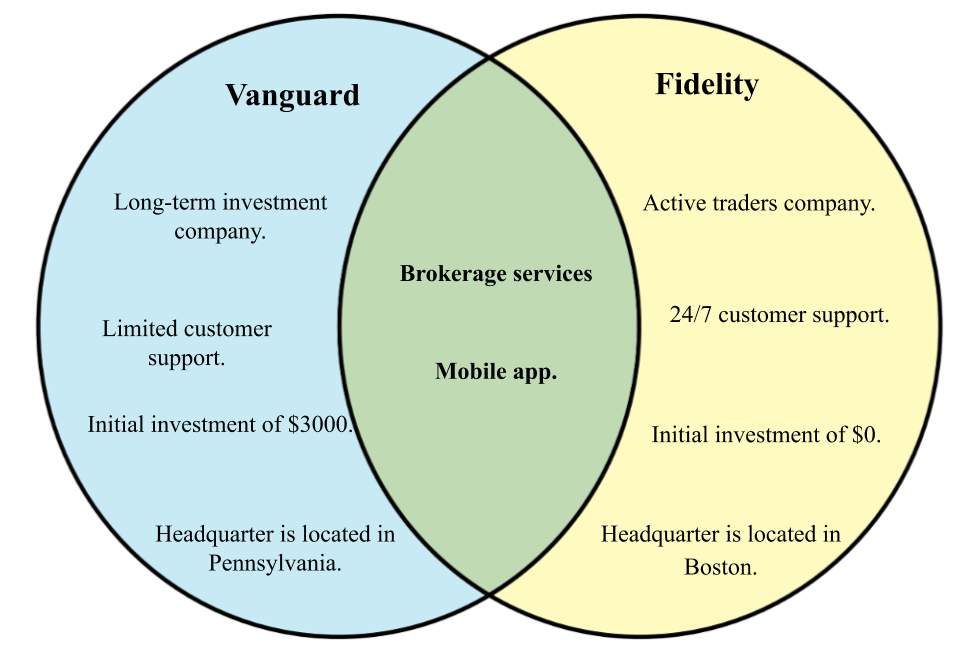

Vanguard and Fidelity are investment providing companies. They deal with financial services. Vanguard is known best for its brokerage services based on fund company. Fidelity primarily acted as mutual funds company, but now it also acts as brokerage firm that offers funds.

Vanguard[edit]

Vanguard company is the largest provider of mutual funds. It also provides Exchange Traded Funds (ETFs). It is ranked as second largest investment company in world. In addition to mutual funds and ETFs, brokerage services are also offered by Vanguard as well as educational account services, financial planning, asset management and trust services etc.

Vanguard main focus is on long-term trading and retirement plans.

Fidelity[edit]

Fidelity is a multinational company providing financial services. Among the various services provided by Fidelity brokerage, mutual funds, funds distribution and investment advice, retirement services, wealth management, cryptocurrency exchange, security execution and life insurance etc. Fidelity has no trading commissions. The research tools and trading platform is top notch.

ETF research offered by Fidelity is from six different providers. Trading is provided by website and mobile app, but for active traders, desktop option is also provided.

| Vanguard | Fidelity | |

|---|---|---|

| Type | It is a long-term investment company. | Investment company for active traders. |

| Headquarters | Headquarters are located in Pennsylvania. | Fidelity has its headquarter in Boston. |

| Active Trading | Little interest to active traders and main focus is on long-term investment. | Desktop feature for active traders and less stress towards long-terms investment. |

| Customer support | Customer support is only from Monday-Friday on 8:00 am-10:00 pm. | Strong customer service available 24/7 on live chat as well. |

| Stock Fee | $0 on first 25 trades and then $2 for each trade. | Commission free stock only costs $4.95 |

| Initial investment | Initial investment is necessary and of $3000. | There is $0 initial investment. |