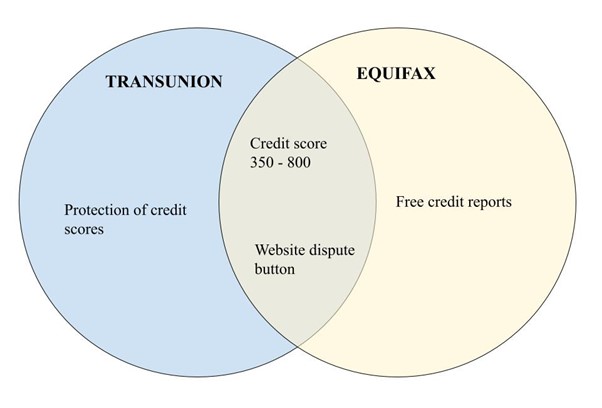

Differences between TransUnion and Equifax

TransUnion and Equifax use proprietary scoring models like other credit reporting agencies. They are similar as they use the same model for scoring. It's noticeable that the TransUnion score is always higher than that of Equifax. This happens because TransUnion adds personal information and the user's employment information into their scoring models. Equifax, on the other hand, doesn't add personal information about employment in their scoring mode. It includes only the employers' info only.

Equifax is more common among car deals and those who lend out automatically. It determines most of their decisions on those who lend from them and influences how they act. It is worthy of note that it is not easy to tell which is more accurate, if TransUnion and Equifax. The user tends to choose the one he prefers of the two depending on what they want.

Transunion.

TransUnion is used for the calculation and protection of credit scores. TransUnion is mainly used to collect and maintain credit scores and reports in the United States of America. The data collected is then used by companies whether to offer, extend, or terminate users' credit. TransUnion is highly regarded among people of the United States as a significant bureau for credit earner as it builds a solid reputation for the user (depending on each case). It is believed to help maximize credit.

Equifax.

Equifax is widely regarded as one of the freeways for getting free credit reports. Given that they get the required information, Equifax provides the correct credit report and it can be trusted. If you are having problems with credit bureaus, Equifax is one of the best ways to check where the problem comes from. An Equifax boost helps in getting a better chance with your loan deals. Equifax updates your credit score once a week.

| TransUnion | Equifax | |

|---|---|---|

| Report charges | Charges for reports ordered through their website. | Charges for reports ordered through their website as well. |

| Report requirements | Employment history and personal information is required. | The name of your employer could be enough. |

| Credit score | 300 – 850 | 300 - 850 |