Difference Between Sole Trader and Partnership

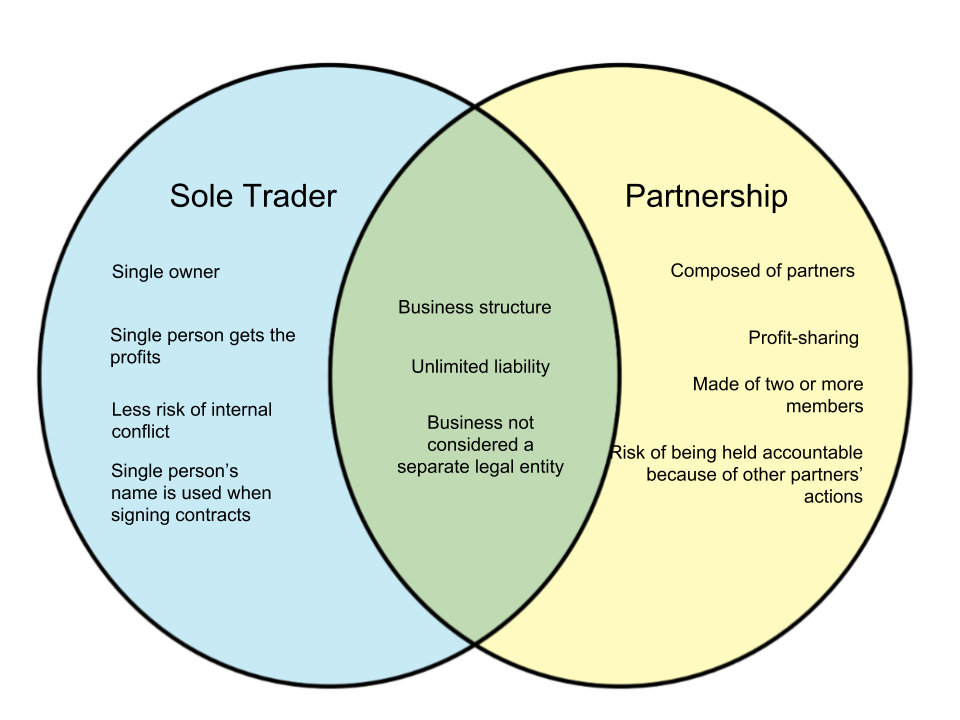

There are three main business structures - sole proprietorship or sole trader, partnership and corporation. In this article, we will touch the topic of a sole trader. Here, we will differentiate a sole trader and partnership.

Sole Proprietorship[edit]

A sole proprietorship is also known as a sole proprietor. Its most basic definition is a business structure that is owned and run by a single individual. This individual invests money, property, assets, skills and labor in order to run the business. He/she may employ workers for the business, but assets and liabilities belong to him/her alone. A sole trader carries the risk of the business as all business contracts will be made under their name. He/she will also undergo unlimited personal liability as debts that the business cannot pay off will be made liable to the individual.

Partnership[edit]

A partnership consists of two or more legal entities that contribute resources, skills and labor for the purpose of profit. Like a sole trader, there is no legal separation between a partnership and its partners. This means that partners will be liable for any debts, losses or legal issues that the partnership will face. A partnership may consist of individuals, corporations, or even other partnerships.

| Sole trader | Partnership | |

|---|---|---|

| Definition | A business owned and run by a single individual | A business structure where two or more partners contribute resources, skills and labor to earn profit |

| Number of owners | 1 | At least 2 |

| Owners | Sole trader/sole proprietor | Partners |

| May consist of | Sole trader, employees | Partners, employees |

| Owners’ means of income | Withdrawals from the business; net income from the business | Profit sharing or salary, the latter sometimes preferred by industrial partners |

| Taxation | No business tax; owner is taxed through individual income tax returns | Partners are taxed based on the profit they earn |

| Separate entity? | No | No |

| Liability | Unlimited | Unlimited |

| Advantages | Lack of conflict, single source of authority, owner keeps all the profits, simple structure | Ease of startup, split costs, support from other partners, equality in ownership and management |

| Disadvantages | Unlimited liability, no legal distinction, taxed as individual, stress from managing business alone | Unlimited liability, shared accountability for debts, losses and legal matters, possibility of internal conflict |