Difference between Credit and Debit

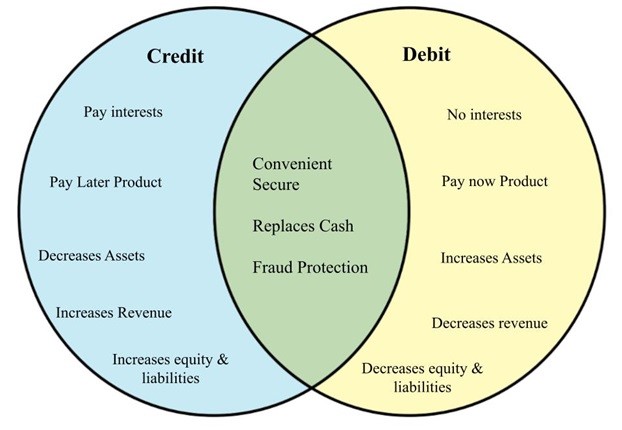

Business transactions are events that have a monetary impact on the financial statements of an organization. A debit is an accounting entry that either increases an asset or increases an expense or decreases a liability or equity account. A credit is an accounting entry that either increases a liability or equity account or decreases an asset or an expense. Debits and credits are used to monitor incoming or outgoing money in your business account. Debit is the money going out of the account while credit is money coming into the account.

Credit.[edit]

Credit is money coming into your account. Credit cards inculcated a financial discipline to repay the debt within a stipulated period. Credit allows withdrawal of cash from ATM in an emergency, allows greater cash backs, and reward points on spending. A credit card can be used as a tool to improve credit scores.

Debit.[edit]

It does not prompt the user to deposit the amount back. It does not allow to make payments over above the balance available in the bank account. It allows cash withdrawal only if you have that amount in the bank account. Lesser cashback offers as compared to credit. It does not impact the credit score. It uses a pin to complete transactions. It can also be used where a credit card can be used. It is good for daily use to help you keep in budget. It is suitable for users who do not want to take a risk of any negatively impacting the credit score.

| Credit | Debit | |

|---|---|---|

| Definition | Credit is a money coming into account. It is similar to a loan, the money coming into your account needs to be payed later on. | Debit is a money going out of account. This means that the money used when using a debit card, for example, is your own money. |

| Eligibility criteria | Certain requirements need to be fulfilled. | Usually there is no major criteria to be fulfilled. |

| Is it a debt instrument? | Yes | No |

| Maximum limit | Determined on credit score, credit history. | A little less than your saving or current account balance. |