Difference between Insurance and Assurance

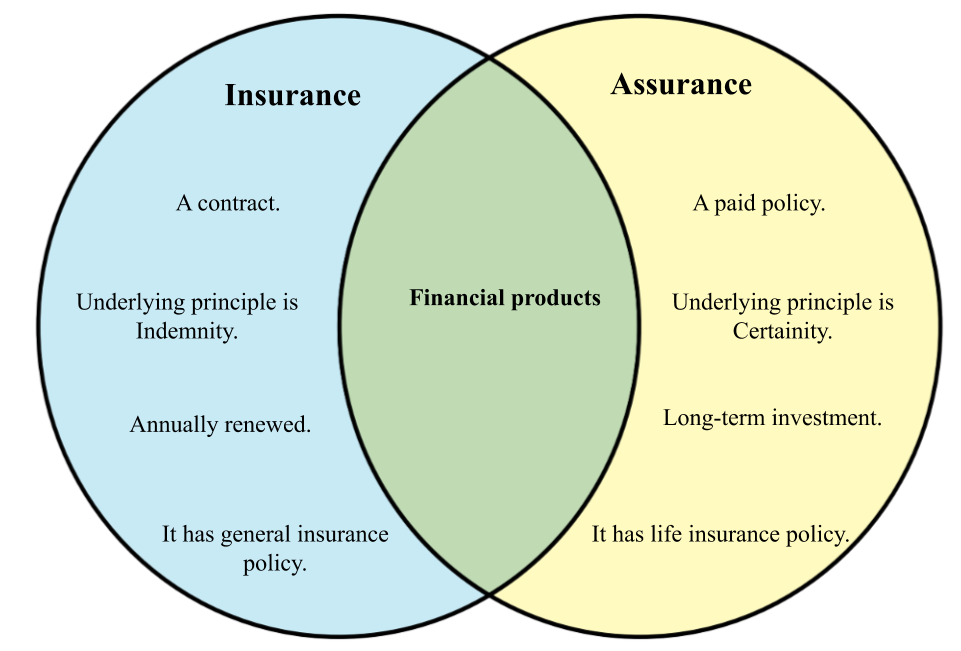

Both of these terms are often used relating to financial planning and policies. These are the contracts between the insured person or insurer. Insurance is a contract while assurance is a paid policy. These are the financial products that provide financial protection to their clients. These are often confused with each other, here are basic differences among both of them.

Insurance[edit]

Insurance is actually a contract between insurer and the insured. It is a form of protection from the financial losses. A professional that provides insurance is called as insurer and the one who gets the insurance from company is called as insured. The contract includes agreement to cover insured person life events that need protection under certain regulatory principles. Insurance is of many types, the insured can have insurance of vehicle, health, income, casualty and burial, life, property and many other similar types.

Assurance[edit]

Assurance is a policy that is paid. It is typically based on a particular life event; we can say that it is the insurance of life. This policy is based on the actual event and will surely happen in the future and the policy pays for that event. Assurance is a type of life insurance, it includes whole life insurance, term life insurance, annuity, trust and endowment. The investment bonus is continuously added to the policy.

| Insurance | Assurance | |

|---|---|---|

| Meaning | It is a contract. | A paid policy. |

| Principle | Insurance has indemnity as underlying principle. | Assurance has certainty as underlying principle. |

| Renewal | Insurance is annually renewed. | It is a long-term investment. |

| Money return | Being a protection means, money can be returned when there is need to claim offered protection. | Being a paid policy, it returns the invested money for particular event. |

| Policy | It has general insurance policy. | It has life insurance policy. |