Difference between Joint Venture and Partnership

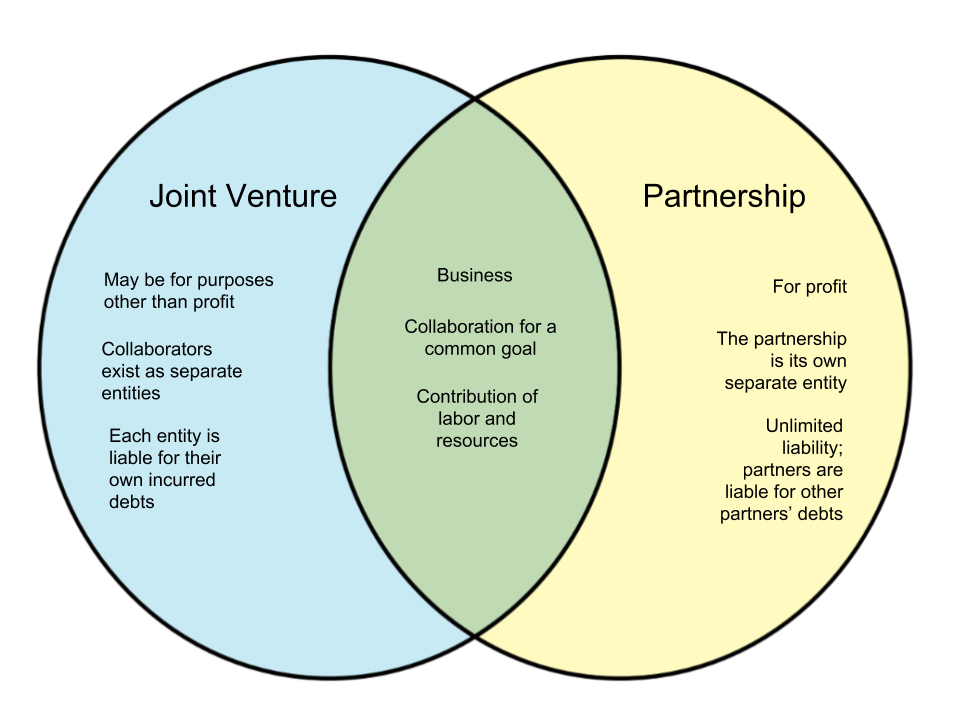

A business can come in different forms, like a sole proprietorship, corporation, joint venture or a partnership. Among these types, joint venture and partnership are commonly mistaken for each other. Here are the variations between a joint venture and partnership.

A joint venture is a contractual agreement between two companies or parties to join together in order to accomplish a particular project or business undertaking. Both parties continue to maintain their own businesses and exist as separate entities. Companies may take part in a joint venture for reasons like research and development, property development, or travel agreements.

A partnership is a form of business wherein partners contribute money, property, and/or industry to pursue a common objective for the sake of profit. Unlike a joint venture, a partnership exists as a single entity. The partners agree on how they contribute to the business as well as stipulate division of profits and losses. A partner can be rendered liable to pay for debts that the other partners cannot pay if it concerns the business.

| Joint venture | Partnership | |

|---|---|---|

| Definition | Two different entities join together in a contractual agreement to pursue a mutual objective | Partners contribute money, property, and/or industry to accomplish a specific objective for the purpose of profit |

| Key Points | A common interest or purpose, joint control, right to a share in profits, a duty to share in the losses, does not necessarily pursue profit | A common interest or purpose, joint control, right to a share in profits, a duty to share in the losses, pursuit of profit, a maximum number of 20 partners |

| As an entity | The involved entities are separate from each other | The partnership itself is the single entity |

| Advantages | Opportunity for business expansion, ability to grow without the need to increase liabilities, development, greater access to resources and labor | Ease of establishment, lower costs, flexibility in business structure, less external regulation, privacy of each partner’s affairs |

| Disadvantages | Risk of breach of trust, lack of collaboration can pull the other entity down, risk of conflicts | Liability and accountability regarding other partners’ debts and actions, division of profit, unlimited liability which can possibly affect personal assets |

| Division of profit and loss | Division at the end of the project | Division based on stipulation, usually based on capital contribution |

| Scope of liability | Each party is liable for their own incurred debts | Unlimited liability (except in the case of limited partners); accountability for the debts incurred by other partners |