Difference between Robinhood and Webull

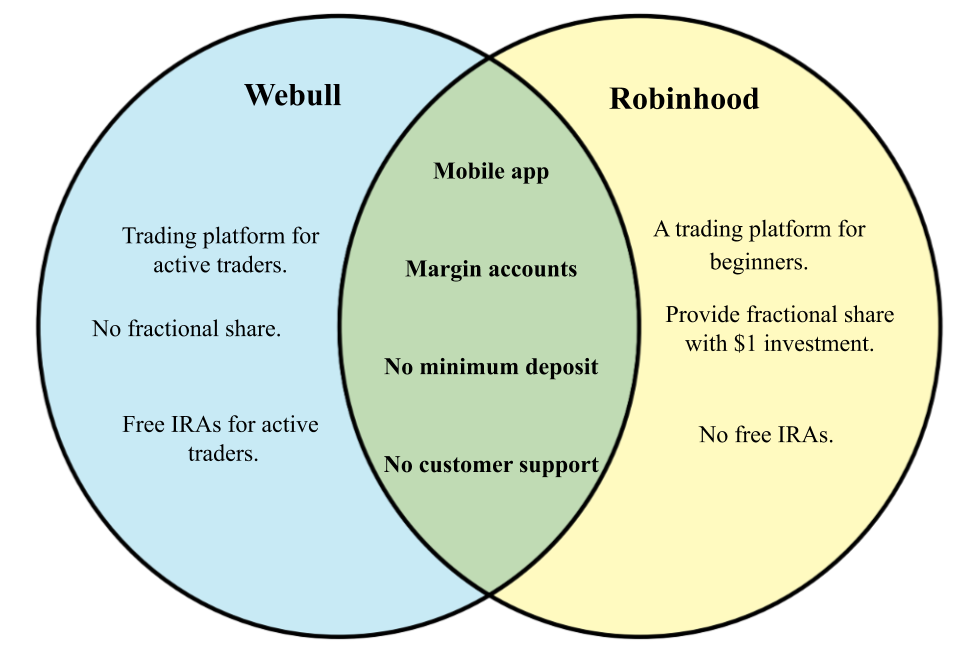

Robinhood and Webull are companies that provide financial services as well as exchange services to their traders and investors. These are free investment platforms that does not require minimum deposit balances.

Robinhood[edit]

Robinhood provides trading services to its investors. It is aimed at providing its services to the beginners without charging them high commissions. It, as expected, lacks few research features and others. However, Robinhood is an excellent platform for cryptocurrency exchange program. During its launch time back in 2013, it was the only platform that offered free trading for beginners.

There are no hidden charges for its investors. Robinhood Gold is one of their services that provides opportunity to the traders to trade on margin. It is their revenue generation point as well.

Webull[edit]

It is one of the latest online brokers for technical traders. Its different features are specifically made for research agency ratings, financial calendar and technical indicators, etc. It is an ideal platform for active traders. There are paid subscriptions for real-time global market data, they also offer margin accounts, just like Robinhood.

As webull is operating on low cost and meant for the beginners, they do not offer any free customer support or live chat feature.

| Robinhood | Webull | |

|---|---|---|

| Type | Free trading platform for beginners. | Free investment platform for active traders. |

| Website or app? | Robinhood has both website and mobile app features. | Webull has only a mobile app. |

| Foundation | Robinhood was founded in 2013. | It was founded in 2016. |

| Fractional shares | Robinhood provides fractional shares with investment just $1. | There are no fractional shares offered by Webull. |

| Services | It offers fractional shares. | Webull offers trading simulator and research tools for active traders and long-term investors. |

| IRA | Not any. | Free IRAs to active traders. |