Difference between Vanguard ETF and Mutual Fund

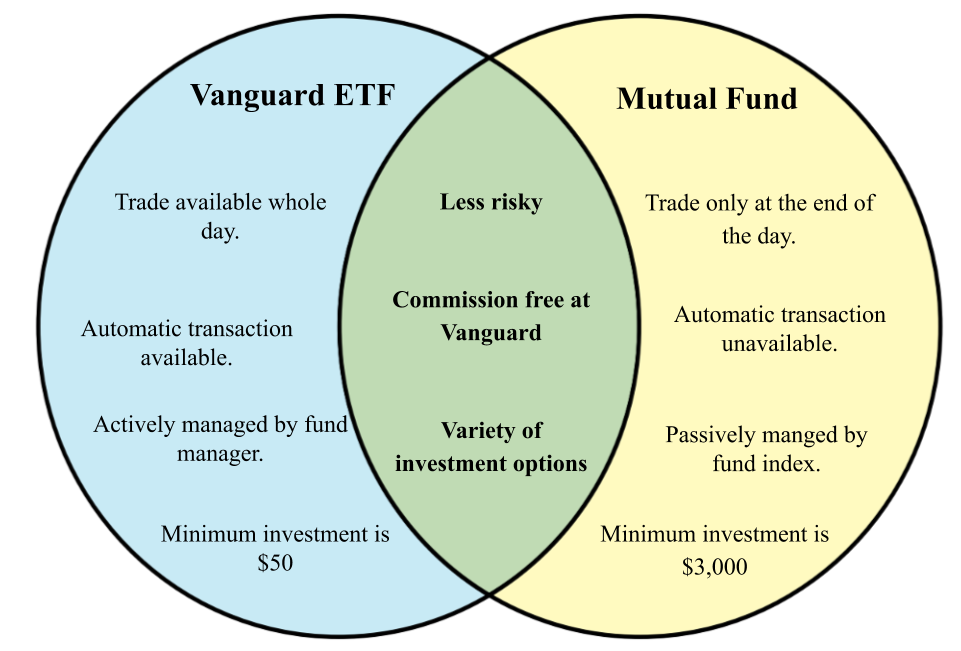

Vanguard ETF and Vanguard Mutual Fund are similar in management style. They both have some technical differences that are suitable for respective investors. ETFs are more flexible than mutual funds. That is because they can be traded like stocks and can easily be sold or bought all throughout the day. Mutual funds have their benefit from economic sales. They can be traded only at the end of the day.

Vanguard ETF[edit]

Vanguard is a well-known financial company due to its mutual funds. Company is owned by funds which in turn are owned by investors. It is important to note here that Vanguard provides low cost ETFs. Due to this reason it is a leading company. ETFs are more suitable for minimum investment amounts to have control over transaction prices.

Mutual Funds[edit]

Mutual funds are professionally managed open ended investment fund. Mutual funds have their advantages as economies of scales, diversification and professional management. There are different types of mutual funds, this classification is based on their principal investment type. It can be bond or fixed income funds, stock or equity funds, hybrid funds or others.

Open-ended and closed-ended mutual funds are available. In open-ended mutual fund trading is between funds and investors. And a limited number of shares are available. While in closed-ended mutual fund there is a set number of shares that is regardless of demand by investor.

| ETF | Mutual fund | |

|---|---|---|

| Trading | Trade is open all day. | Trade is only once at the end of the day. |

| Automatic transaction | Available | Not available |

| Stocks prices | Stocks are traded in ETF. | Calculated price is used to purchase mutual funds. |

| Management | Vanguard ETF is actively managed by the fund manager. | Based on the market index, mutual fund is passively managed. |

| Assets | $3.37 trillion assets calculated in Dec 2018. | $17.71 trillion assets calculated in Dec 2018. |

| Types | Three types of ETF are open-ended index mutual funds. | Open-ended and closed-ended mutual funds are available. |

| Investment minimum | ETF can be purchased at the price of one share, price is as low as $50 and as high as few hundred dollars. | The minimum investment amount for mutual funds is $3,000 that can buy 30 shares. |