Differences between Accounts Payable and Accounts Receivable

Accounts Payable vs. Accounts Receivable[edit]

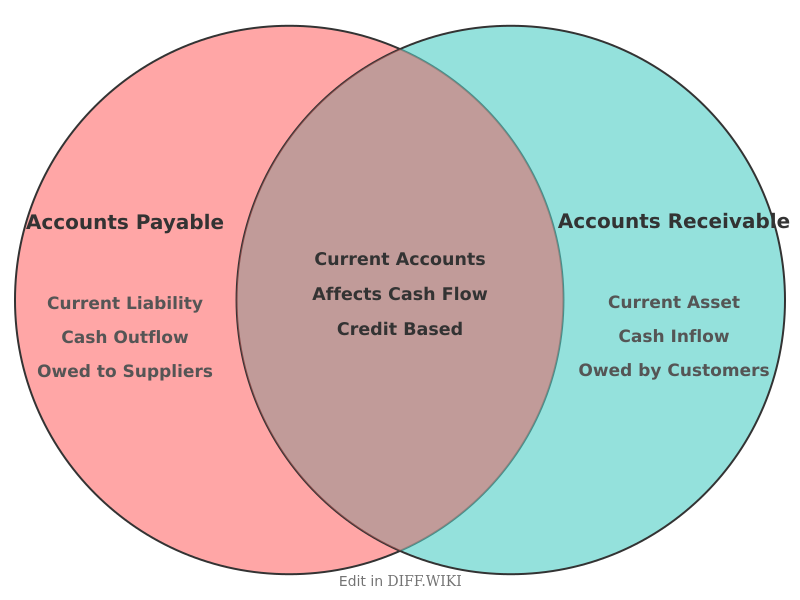

In business accounting, accounts payable (AP) and accounts receivable (AR) represent two opposite sides of a company's short-term financial obligations and assets.[1][2] Accounts payable is the money a business owes to its suppliers for goods or services purchased on credit.[3][4] Conversely, accounts receivable is the money owed to a business by its customers for goods or services they have received but not yet paid for.[5] Both are critical components in managing a company's cash flow and overall financial health.

Accounts payable is classified as a current liability on a company's balance sheet, signifying a short-term debt that is expected to be paid within a year. The management of AP is handled by an accounts payable department, which is responsible for processing invoices, verifying their accuracy, and ensuring timely payments to maintain good relationships with suppliers.

On the other hand, accounts receivable is listed as a current asset on the balance sheet, as it represents money that will likely be converted to cash within a year. The accounts receivable department manages the invoicing of customers, tracks incoming payments, and conducts collection activities to ensure the business receives the money it is owed. The efficient management of both AP and AR is crucial for a company's liquidity and operational stability.[2]

Comparison Table[edit]

| Category | Accounts Payable (AP) | Accounts Receivable (AR) |

|---|---|---|

| Definition | Money a company owes to its suppliers or vendors for goods or services purchased on credit.[3] | Money owed to a company by its customers for goods or services delivered on credit. |

| Financial Statement Classification | Current Liability on the balance sheet. | Current Asset on the balance sheet. |

| Represents | A company's short-term payment obligations (money going out). | A company's right to collect money from customers (money coming in). |

| Involves | Suppliers and vendors. | Customers.[5] |

| Core Process | Receiving and paying invoices from suppliers. | Creating and sending invoices to customers and collecting payment. |

| Impact on Cash Flow | Represents a cash outflow; payments decrease the company's cash. | Represents a cash inflow; collections increase the company's cash. |

See also[edit]

- Balance sheet

- Cash flow management

- Working capital

References[edit]

- ↑ "bill.com". Retrieved December 26, 2025.

- ↑ 2.0 2.1 "finli.com". Retrieved December 26, 2025.

- ↑ 3.0 3.1 "mineraltree.com". Retrieved December 26, 2025.

- ↑ "wikipedia.org". Retrieved December 26, 2025.

- ↑ 5.0 5.1 "wikipedia.org". Retrieved December 26, 2025.