Differences between Acquisition and Merger

Contents

Acquisition vs. Merger[edit]

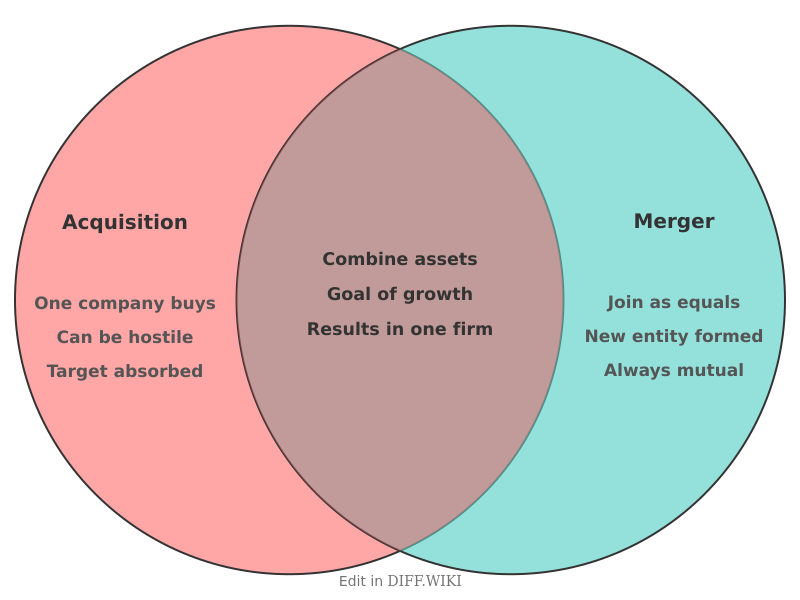

An acquisition is a transaction where one company purchases a majority or all of another company's shares to take control.[1][2] In contrast, a merger is the combination of two companies into a new legal entity. The terms are often used interchangeably, though they denote different financial and legal processes.[1][3]

Comparison Table[edit]

| Category | Acquisition | Merger |

|---|---|---|

| Resulting Entity | The acquiring company absorbs the target company, which may cease to exist as an independent entity or become a subsidiary.[4][5] | A new company is formed, and the original companies cease to exist. |

| Identity | The acquiring company's identity is maintained. | A new, combined identity is often created. |

| Size of Companies | The acquiring company is typically larger than the target company. | The companies are often of similar size and stature. |

| Control | The acquiring company gains control over the acquired company. | Control is shared between the leadership of the two original companies. |

| Nature of Transaction | Can be friendly or hostile, where the target company's management may not approve of the transaction.[5] | Generally a mutual and voluntary agreement between the two companies. |

Notable Examples[edit]

A well-known example of an acquisition is Google's purchase of Android in 2005. Google acquired the smaller mobile startup, and Android now operates as a subsidiary under its parent company. Another prominent acquisition was Microsoft's purchase of the professional networking site LinkedIn.

The 2015 transaction between Dow Chemical and DuPont is an example of a merger of equals, creating the new entity DowDuPont. Another significant merger was the 2006 union of Disney and Pixar, which combined the strengths of both animation studios.

Strategic Motivations[edit]

Companies pursue acquisitions and mergers for a variety of strategic reasons. A primary driver for both is to achieve synergies, where the combined entity is more valuable than the two independent companies.[4] This can be accomplished through economies of scale, increased market share, or the acquisition of new technology or talent.

Acquisitions are often a quicker way for a company to enter a new market or to eliminate a competitor. Mergers, being more collaborative, can be a way to pool resources and share risks in a new venture. Both transactions are complex and require significant due diligence to assess the financial health and potential risks of the companies involved.[4]

References[edit]

- ↑ 1.0 1.1 "investopedia.com". Retrieved January 31, 2026.

- ↑ "theforage.com". Retrieved January 31, 2026.

- ↑ "investopedia.com". Retrieved January 31, 2026.

- ↑ 4.0 4.1 4.2 "wikipedia.org". Retrieved January 31, 2026.

- ↑ 5.0 5.1 "greatlawyers.com". Retrieved January 31, 2026.