Differences between Bank and Credit Union

Contents

Bank vs. Credit Union[edit]

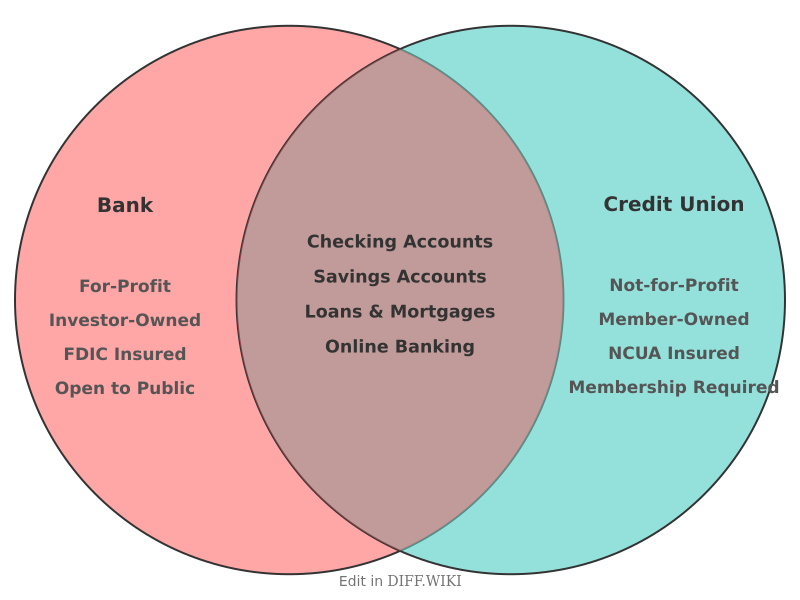

Banks and credit unions are both financial institutions that offer a range of similar services, including checking and savings accounts, loans, and credit cards.[1][2] However, they differ fundamentally in their ownership structure and primary objectives.[3] A bank is a for-profit entity owned by shareholders, while a credit union is a not-for-profit cooperative owned by its members.[4] This core distinction influences various aspects of their operations, from fee structures to customer service.[5]

Comparison Table[edit]

| Category | Bank | Credit Union |

|---|---|---|

| Ownership | Owned by private investors or shareholders. | Owned by its members (customers). |

| Primary Goal | To generate profit for its owners.[4] | To provide low-cost financial services to its members. |

| Governance | Governed by a board of directors chosen by stockholders. | Governed by a volunteer board of directors elected by members. |

| Eligibility | Open to the general public.[4] | Membership is typically restricted based on a common bond, such as employment, geographic location, or affiliation with an organization.[4] |

| Tax Status | For-profit, subject to federal income tax.[1] | Not-for-profit, generally exempt from federal income tax.[1] |

| Deposit Insurance | Deposits are insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC). | Deposits are insured up to at least $250,000 by the National Credit Union Administration (NCUA). |

| Interest Rates & Fees | Generally have higher fees and lower interest rates on savings accounts.[1][5] | Typically offer lower fees and higher interest rates on savings accounts and lower rates on loans.[1] |

| Accessibility | Often have a larger network of branches and ATMs.[1] | May have fewer physical branches but often participate in shared branch and ATM networks.[1] |

Regulation and Oversight[edit]

Both banks and credit unions are subject to federal regulation. Banks are primarily regulated by federal agencies such as the Office of the Comptroller of the Currency (OCC) and the Federal Reserve.[4] Credit unions are regulated by the National Credit Union Administration (NCUA), an independent federal agency that also charters and supervises federal credit unions.[4]

Deposit insurance is a key similarity between the two types of institutions. The FDIC and the NCUA are both federal agencies that provide deposit insurance of up to $250,000 per depositor, ensuring the safety of customers' funds in the event of an institution's failure. While FDIC insurance is mandatory for all banks in the United States, the requirement for NCUA insurance for credit unions can depend on state law.

Product Offerings and Technology[edit]

Banks and credit unions offer a comparable range of financial products, including various types of checking and savings accounts, mortgage and auto loans, personal loans, and credit cards.[2] Banks, particularly larger national institutions, may offer a broader array of products and services, especially for business and commercial accounts.

Historically, banks have been quicker to adopt new technologies and may offer more advanced online and mobile banking features.[1] However, many credit unions have invested in modern digital banking solutions and participate in large, cooperative ATM and shared branch networks to enhance accessibility for their members.

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 "investopedia.com". Retrieved February 05, 2026.

- ↑ 2.0 2.1 "fsfcu.com". Retrieved February 05, 2026.

- ↑ "nerdwallet.com". Retrieved February 05, 2026.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 "creditunion1.org". Retrieved February 05, 2026.

- ↑ 5.0 5.1 "argentcu.org". Retrieved February 05, 2026.