Differences between Branch Banking and Unit Banking

Contents

Branch banking vs. unit banking[edit]

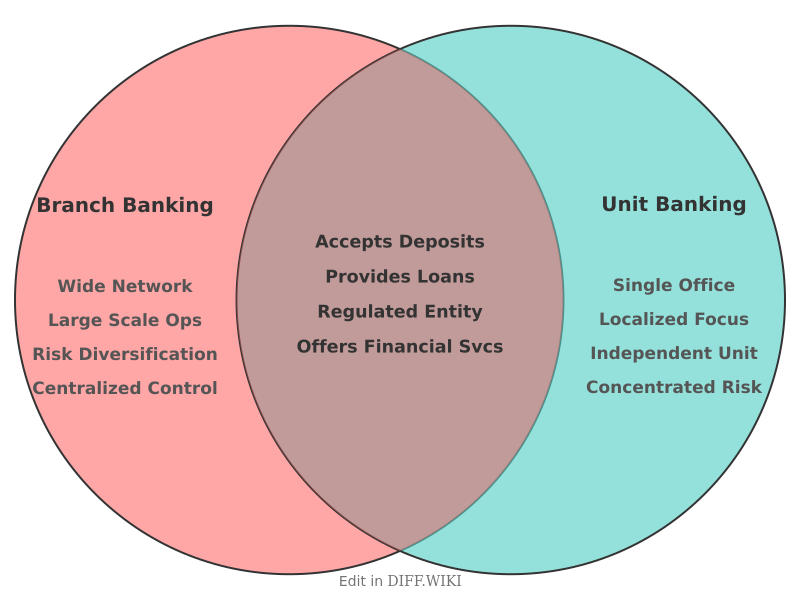

Branch banking and unit banking represent two distinct structural models for banking operations.[1] In a branch banking system, a single banking institution conducts its business through a network of branch offices.[2][3] These branches operate under the centralized management of a head office.[1] Conversely, unit banking involves a single, independent bank that typically operates from one office, serving a limited geographic area without a branch network.[4] The unit banking model originated and was historically prevalent in the United States, influenced by regulations intended to prevent monopolies and encourage local control.[5] Most modern banking systems globally, including those in India and the United Kingdom, utilize the branch banking model.[1]

Comparison table[edit]

| Category | Branch Banking | Unit Banking |

|---|---|---|

| Structure | A network of branches controlled by a central head office.[3] | A single, independent bank operating from one office.[4] |

| Geographic reach | Wide; can operate across cities, states, and countries.[1] | Limited; confined to a specific local community or area. |

| Risk diversification | High; risks are spread across different regions and economies. | Low; risks are concentrated in the local economy. |

| Resource allocation | Funds can be pooled and transferred between branches as needed. | Relies on limited financial resources generated from its single location.[3] |

| Operational scale | Large-scale operations lead to economies of scale, potentially lowering costs. | Small-scale operations may have higher operating costs. |

| Decision-making | Centralized at the head office, which can lead to slower decisions. | Localized and independent, allowing for faster decision-making.[4][1] |

| Customer relationship | Can be less personalized due to standardized procedures. | Often allows for closer, more personalized relationships with customers.[4][1] |

Characteristics of branch banking[edit]

The branch banking model allows financial institutions to reach a broad customer base over a large geographical area.[2] By operating a network of branches, banks can achieve economies of scale, sharing the costs of infrastructure, technology, and administration across many locations, which can increase efficiency. This structure permits the diversification of risk; an economic downturn affecting one region can be offset by stability or growth in others.

However, the branch banking system can also present challenges. Decision-making is centralized, and branch managers may have limited authority, potentially leading to delays and a lack of responsiveness to local issues. The system can also lead to regional imbalances, where funds deposited in smaller communities are transferred to larger industrial centers.

Characteristics of unit banking[edit]

A unit bank's operations are deeply connected to its local community. This localized focus allows it to have a specialized understanding of local economic conditions and maintain close, personal contact with its customers.[4] Management is contained within a single office, which allows for simpler supervision and quicker, more responsive decision-making.[4]

The primary disadvantage of unit banking is its concentration of risk. Since its business is tied to a single locality, a unit bank is vulnerable to local economic downturns and has a limited ability to withstand financial crises. Its financial resources are restricted to what it can raise locally, and it cannot achieve the economies of scale seen in branch banking.[3] For services like fund transfers, unit banks often have to rely on correspondent banks, which can be more expensive.[4]

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 "gktoday.in". Retrieved January 03, 2026.

- ↑ 2.0 2.1 "hotbot.com". Retrieved January 03, 2026.

- ↑ 3.0 3.1 3.2 3.3 "wallstreetmojo.com". Retrieved January 03, 2026.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 4.6 "blogspot.com". Retrieved January 03, 2026.

- ↑ "gktoday.in". Retrieved January 03, 2026.