Differences between Coinsurance and Copay

Coinsurance vs. Copay[edit]

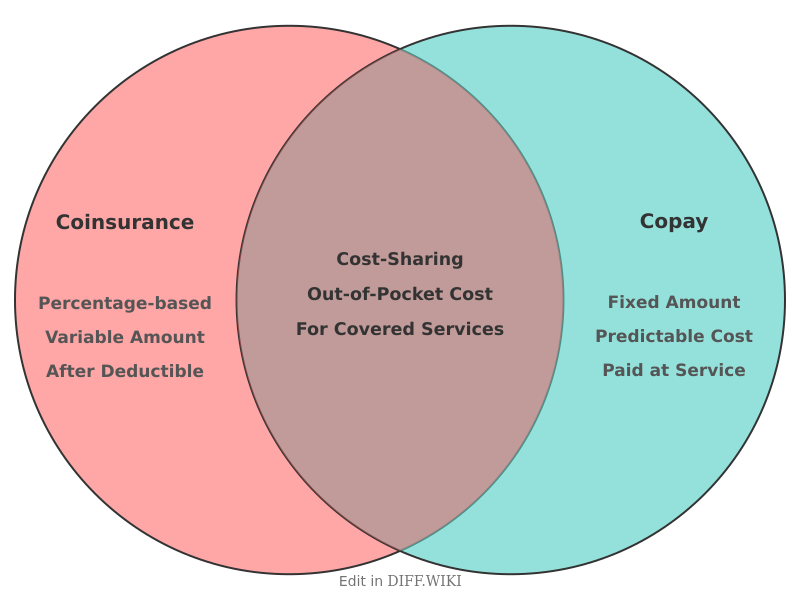

In the context of health insurance, coinsurance and copayments (commonly referred to as copays) are both forms of cost-sharing, meaning the insured individual pays a portion of their healthcare costs, and the insurance company pays the rest.[1] However, they are calculated differently and applied at different times. A copay is a fixed fee paid by the insured person for a covered medical service at the time of the service.[2] Coinsurance is a percentage of the total cost of a covered healthcare service that the insured person pays after their deductible has been met.[3]

A key distinction lies in the structure of the payment. Copayments are predetermined, flat fees for specific services.[4] For instance, a health insurance plan might require a $25 copay for a visit to a primary care physician or a $50 copay for a specialist.[5] This amount is typically paid at the time of the appointment.

In contrast, coinsurance is a percentage of the allowed amount for a service. For example, with an 80/20 coinsurance plan, the insurance company pays 80% of the cost, and the insured individual pays the remaining 20%. Coinsurance payments usually begin after the insured has met their annual deductible, which is the amount an individual must pay for covered health care services before their insurance plan starts to pay.

Both copayments and coinsurance contributions often count towards an individual's out-of-pocket maximum for the year. Once this maximum is reached, the insurance plan typically covers 100% of the costs for covered services for the remainder of the policy year.

Comparison Table[edit]

| Category | Coinsurance | Copay |

|---|---|---|

| Payment Structure | Percentage of the total cost of the service.[3] | Fixed, flat fee for a specific service. |

| When it is Paid | After the annual deductible has been met. | Typically at the time the service is rendered. |

| Amount | Varies depending on the total cost of the service. | A predetermined amount that remains the same for each specific service.[1] |

| Example | A patient pays 20% of the cost of a hospital stay. | A patient pays a $25 fee for a doctor's visit.[5] |

| Relationship to Deductible | Only applies after the deductible is met. | May apply before or after the deductible is met, depending on the plan. |

| predictability | Less predictable, as the amount depends on the overall cost of care. | Highly predictable, as the fee is fixed for each service.[2] |

Not all health insurance plans utilize both copays and coinsurance. Some plans may use one or the other, or a combination of both, depending on the type of service provided. The specifics of an individual's copay and coinsurance responsibilities are outlined in their health plan documents.

References[edit]

- ↑ 1.0 1.1 "tuftsmedicarepreferred.org". Retrieved December 31, 2025.

- ↑ 2.0 2.1 "uhc.com". Retrieved December 31, 2025.

- ↑ 3.0 3.1 "ehealthinsurance.com". Retrieved December 31, 2025.

- ↑ "sesamecare.com". Retrieved December 31, 2025.

- ↑ 5.0 5.1 "nerdwallet.com". Retrieved December 31, 2025.