Differences between E*TRADE and Scottrade

E*TRADE vs. Scottrade[edit]

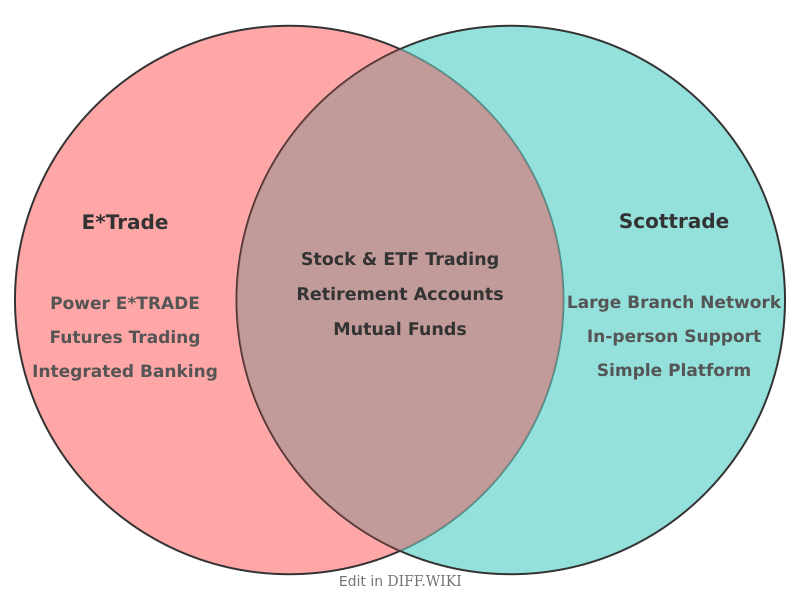

Before the acquisition of Scottrade by TD Ameritrade in 2017, both E*TRADE and Scottrade were prominent brokerage firms in the United States, each catering to retail investors but with different service models.[1] E*TRADE was a pioneer in online trading, known for its digital platforms, while Scottrade distinguished itself with a large network of physical branch offices, offering in-person customer support.[2] Their differences in fees, platform technology, and service offerings represented a key choice for investors selecting a brokerage during that time.

The landscape of the brokerage industry has since shifted significantly. TD Ameritrade acquired Scottrade in a $4 billion deal that closed in September 2017, with client accounts fully transitioning by February 2018.[3][2] Subsequently, Charles Schwab acquired TD Ameritrade, a transaction announced in late 2019 and valued at approximately $26 billion.[4] In October 2020, Morgan Stanley completed its acquisition of E*TRADE. These consolidations mean that a direct comparison between E*TRADE and Scottrade reflects a historical perspective of the retail brokerage environment prior to 2017.

Comparison Table[edit]

| Category | E*TRADE (circa 2016) | Scottrade (circa 2016) |

|---|---|---|

| Stock Trade Commission | $9.99 per trade for most clients.[5] | $7 per online trade. |

| Trading Platforms | Offered multiple platforms, including the advanced Power E*TRADE, E*TRADE Web, and mobile apps tailored for different levels of trading activity. | Provided several platform options, including a standard web-based platform, Scottrader for active traders, and the downloadable Scottrade Elite.[5] |

| Customer Support | Primarily online and phone-based, with 24/7 customer service availability via phone and online chat. It also operated around 30 regional branches. | Emphasized in-person support with a network of over 500 branch offices across the United States. Phone support was also available. |

| Account Minimum | No minimum deposit required to open a standard brokerage account.[5] | $2,500 minimum deposit to open an online brokerage account. |

| Investment Products | Offered a wide range of products including stocks, options, ETFs, a large selection of mutual funds, futures, and bonds. | Provided access to stocks, options, ETFs, over 14,500 mutual funds, and bonds. |

| No-Transaction-Fee Mutual Funds | Provided access to a significant number of no-transaction-fee (NTF) mutual funds. | Offered a selection of NTF mutual funds, but the holding period to avoid a short-term trading fee was 90 days. |

References[edit]

- ↑ "advisorhub.com". Retrieved January 20, 2026.

- ↑ 2.0 2.1 "oreateai.com". Retrieved January 20, 2026.

- ↑ "reddit.com". Retrieved January 20, 2026.

- ↑ "reddit.com". Retrieved January 20, 2026.

- ↑ 5.0 5.1 5.2 "etrade.com". Retrieved January 20, 2026.