Differences between Economics and Finance

Differences between Economics and Finance[edit]

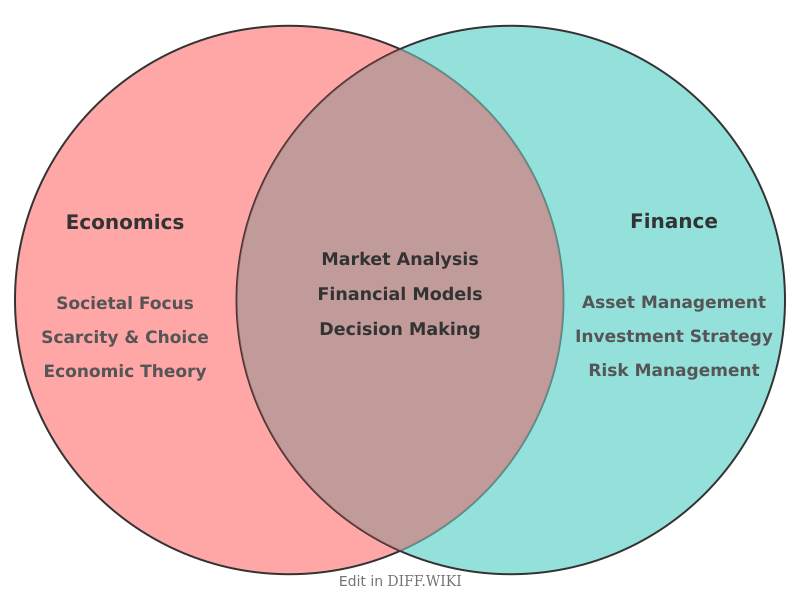

Economics and finance are related disciplines that both address the allocation and management of resources, but they differ in their scope, focus, and approach.[1] Economics is a broad social science concerned with the production, distribution, and consumption of goods and services.[2][3] Finance is a more specialized field, often considered a branch of economics, that focuses on the management of money, assets, and investments.[1][4]

Economics analyzes the bigger picture of how markets and economies function.[5] It is divided into two main branches: macroeconomics, which studies economy-wide phenomena like inflation and economic growth, and microeconomics, which examines the behavior of individual agents such as households and firms.[5] The field addresses broad questions about resource allocation, human behavior, and the impact of government policies on markets.[1][3]

Finance concentrates on the practical application of financial principles. It involves the techniques and tools for managing money and valuing assets.[1] The discipline is typically broken down into three main areas: public finance, corporate finance, and personal finance.[1] Professionals in this field deal with topics like investment analysis, risk management, and financial planning. While economics often takes a theoretical approach to understand broad trends, finance is generally more applied, focusing on specific financial decisions and strategies within the larger economic environment.

Comparison Table[edit]

| Category | Economics | Finance |

|---|---|---|

| Primary Focus | Studies the production, distribution, and consumption of goods and services; analyzes entire economies.[2][5] | Focuses on the management of money, banking, credit, investments, and assets.[1] |

| Scope | Broad; encompasses everything from individual choices (micro) to national and global trends (macro). | Narrower; concentrates on financial markets, instruments, and decision-making for individuals, corporations, and governments. |

| Approach | More theoretical and abstract, using models to understand and predict economic phenomena. | More practical and applied, focusing on strategies for managing assets and mitigating risk. |

| Core Questions | How are scarce resources allocated? What are the effects of policy on the economy? What drives economic growth?[5][3] | How should money be invested? What is the value of an asset? How should financial risk be managed?[4] |

| Key Concepts | Supply and demand, scarcity, opportunity cost, inflation, market failure. | Time value of money, risk and return, cash flow, asset valuation. |

| Primary Tools | Econometrics, statistical analysis, mathematical modeling.[5] | Financial statement analysis, valuation models, portfolio management strategies. |

| Career Paths | Policy analyst, researcher, consultant, government economist. | Financial analyst, investment banker, portfolio manager, corporate finance officer. |

While distinct, the two fields are highly interrelated. Finance relies on economic theories to inform investment decisions and understand market behavior.[3] For example, a financial analyst might use macroeconomic data on inflation and growth to forecast corporate earnings. Conversely, economists study the behavior of financial markets as a key component of the overall economy.[5] The distinction between the two has become less pronounced over time, as both fields increasingly employ quantitative methods to analyze complex financial and economic systems.[1]

References[edit]

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 "investopedia.com". Retrieved February 08, 2026.

- ↑ 2.0 2.1 "purdue.edu". Retrieved February 08, 2026.

- ↑ 3.0 3.1 3.2 3.3 "psu.edu". Retrieved February 08, 2026.

- ↑ 4.0 4.1 "quora.com". Retrieved February 08, 2026.

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 "wlv.ac.uk". Retrieved February 08, 2026.