Differences between Endowment and Whole Life Insurance

Endowment vs. Whole Life Insurance[edit]

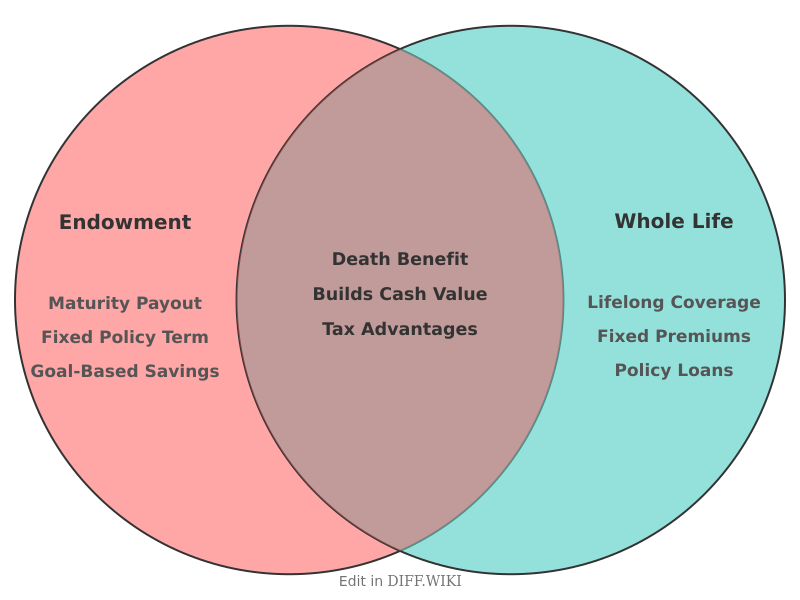

Endowment and whole life insurance are both types of life insurance policies that include a savings or investment component, but they differ in their primary objectives, coverage duration, and payout structure.[1][2] An endowment policy is designed to pay a lump sum after a specified term or upon the policyholder's death, whichever comes first.[3][4] Whole life insurance, conversely, provides coverage for the insured's entire lifetime, as long as premiums are paid, with a focus on providing a death benefit to beneficiaries.[5]

An endowment policy combines elements of a term life insurance policy with a savings vehicle. The policyholder selects a term, typically between 10 and 30 years, and at the end of this term, if the insured person is still alive, the policy "matures" and pays out the face value.[3] If the insured dies during the term, the policy pays a death benefit to the beneficiaries, which is typically the same amount as the maturity benefit. This structure makes endowment policies suitable for goal-oriented savings, such as funding a child's education or saving for retirement.[2][4]

Whole life insurance is a form of permanent life insurance. It features a guaranteed death benefit, level premiums that do not increase over time, and a cash value component that grows at a fixed rate. The cash value accumulates on a tax-deferred basis and can be accessed by the policyholder during their lifetime through loans or withdrawals.[5] Upon the death of the insured, the beneficiaries receive the death benefit. The cash value is an integral part of the death benefit, not a separate amount paid in addition to it. The primary purpose is often to provide financial security for dependents, cover final expenses, or for estate planning purposes.[4]

Comparison Table[edit]

| Category | Endowment Insurance | Whole Life Insurance |

|---|---|---|

| Primary Goal | Savings for a specific goal with an insurance component.[2] | Lifelong financial protection for beneficiaries with a cash value component.[5][2] |

| Coverage Duration | A fixed term, such as 10, 15, or 20 years.[3] | The entire lifetime of the insured person, provided premiums are paid.[5] |

| Maturity Benefit | A lump sum is paid to the policyholder if they survive the policy term. | The policy does not "mature" in the same way; the cash value equals the death benefit at an advanced age (e.g., 100 or 121). |

| Payout Trigger | Upon the policy's maturity date or the death of the insured, whichever occurs first.[4] | Upon the death of the insured person.[5] |

| Premium Cost | Generally higher than whole life insurance for a comparable face amount due to the shorter savings period.[4] | Typically lower than endowment premiums for the same face amount, spread over a longer period.[4] |

| Cash Value Access | Typically accessed at the end of the term as a maturity benefit. | Can be borrowed against or withdrawn during the policyholder's lifetime. |

References[edit]

- ↑ "selectquote.com". Retrieved December 23, 2025.

- ↑ 2.0 2.1 2.2 2.3 "policybazaar.ae". Retrieved December 23, 2025.

- ↑ 3.0 3.1 3.2 "wikipedia.org". Retrieved December 23, 2025.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 "einsurance.com.ng". Retrieved December 23, 2025.

- ↑ 5.0 5.1 5.2 5.3 5.4 "investopedia.com". Retrieved December 23, 2025.